Accessibility

Accessibility, in the context of managed FX accounts with low minimum starting capital, refers to the ability for individuals with limited funds to participate in the forex market.

Traditionally, forex trading has been associated with high entry barriers, such as large capital requirements, complex trading platforms, and specialised knowledge. This made it difficult for individuals with limited resources to engage in forex trading.

However, low minimum starting capital FX managed accounts aim to overcome these barriers by providing an accessible entry point for investors.

The low minimum entry requirement allows individuals to begin investing in the forex market with a smaller amount of money, which can be an advantage for those who do not have significant funds available for investment.

By reducing the minimum capital requirement, managed FX makes it easier for a broader range of investors to participate. This inclusivity can be particularly beneficial for individuals who are new to forex trading or have limited financial resources to allocate.

It allows them to gain exposure to the forex market and potentially benefit from its potential returns.

Furthermore, accessibility extends beyond the minimum capital requirement. Managed FX often provides user-friendly platforms and interfaces that simplify the trading process.

This makes it easier for investors to monitor their investments, view performance reports, and stay informed about market activities.

Additionally, FX managed accounts may offer educational resources, research materials, and support from the fund managers or investment firms.

These resources can help investors gain a better understanding of the forex market, trading strategies, and risk management techniques. Such support and guidance contribute to the accessibility of managed FX by empowering investors with knowledge and assistance to make informed investment decisions.

The enhanced accessibility of managed FX with low minimum starting capital opens up opportunities for a wider range of individuals to participate in the forex market. It allows investors with limited funds to diversify their investment portfolios, potentially benefit from currency movements, and access the expertise of professional fund managers.

You can find out much more about managed FX in general by visiting our page acorn2oak-fx.com/managedforexaccounts.html

Low Capital Requirements

The specific low capital requirements can vary depending on the fund manager or investment firm offering the service.

There are however, some general low capital requirements that you may come across:

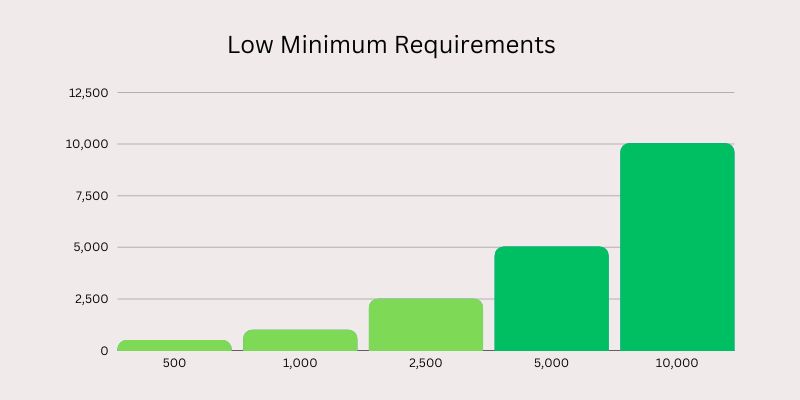

Minimum Investment of $500: Some companies may have a minimum investment requirement as low as $500. This allows individuals with limited funds to participate in the forex market and benefit from professional management.

Minimum Investment of $1,000: Another common minimum investment requirement is around $1,000. This still provides a relatively low barrier to entry and enables investors with modest capital to access the forex market.

Minimum Investment of $2,500: Some of them may have a minimum investment requirement of $2,500. While slightly higher than the previous examples, it still represents a relatively low capital requirement compared to other investment opportunities.

It’s important to note that these figures are provided as examples and actual minimum investment requirements can vary among different providers.

Some providers may have higher minimum capital requirements, while others may offer even lower minimums. It’s essential to research and compare different providers to find one that aligns with your financial goals and available capital.

Additionally, it’s worth mentioning that while low minimum capital requirements can make forex trading more accessible, it’s crucial to consider the potential risks involved.

Forex trading carries inherent market risks, and investments can be subject to fluctuations and potential losses.

It’s always advisable to carefully assess the investment opportunity, conduct due diligence on the fund manager or investment firm, and evaluate the risk and reward potential before committing funds to managed FX.

If you want to compare performance results and fees of low minimum managed FX providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements