How to Choose Your Foreign Currency Exchange Broker

Trading is an activity that interests many people. Whether beginner or experienced, a trader needs a broker. However, choosing one is not something to be taken lightly. There are some very important criteria to consider.

READ ALSO: Forex Brokers Reviews

The Importance of a Broker

The broker plays an essential role in the foreign currency exchange market. Indeed, it serves as an intermediary between the trader and the interbank market.

They allow the trader to execute his selling and buying operations at the best price. This collaboration is possible when the trader opens an account on their platform.

This account must however be suitably researched and validated. After that, the trader can safely carry out his actions of sale and purchase. He can then withdraw money that he has earned through these transactions.

To compare cutting edge Forex Brokers with an easy-to-use interface, fill in your details in our enquiry form, and we will get back at you with up to 4 FREE quotes for you to assess and review

GET FREE QUOTES

The Different Types of Brokers

Before even engaging in the search for one, you must first decide the type you want to choose. Indeed, there are two main categories of brokers.

These are the “Dealing desk” and the “no dealing desk” types.

These two categories differ in the execution of orders given by the trader to the broker. Indeed, the no dealing desk ones carry out traders’ orders to the letter, they do not make any modification, no analysis. They transmit them directly to the market as received.

The dealing desk ones meanwhile first study the orders they receive before transmitting them to the market. They study orders at their level and transmit them to the market on their behalf.

However, the trader may not agree when the actions carried out by the broker do not comply with the wishes of the trader.

This could be a source of frustration for the trader since his orders are not executed to the letter. However, the trader could trust him since the broker is more experienced. So he knows what he is doing.

The Characteristics of a Good Broker

A good one must have certain characteristics. However, the characteristics to be considered will depend on the level of experience of the trader whether he is a beginner or experienced.

They Must Offer You a Platform That Suits You

It is very important that they provide you with a platform that suits you. Indeed, you must be perfectly comfortable on the trading platform offered by your broker.

This platform must perfectly match your needs. It should also be easy to use, especially for beginners. So this is something you should watch out for before signing up.

They Must Offer a Secure and Reliable Platform

The relationship between the broker and the trader is a relationship based on trust. Indeed, the trader must be able to trust his completely.

This is given the fact that it plays a very important role. Since they are responsible for managing your capital and carrying out your buying and selling operations, he must be able to present you with a secure platform.

Indeed, these platforms can be hacked, which means that you risk losing all your money. Your broker must therefore have all the tools necessary for his security.

However, to avoid all kinds of problems, you can just choose one that has been recommended.

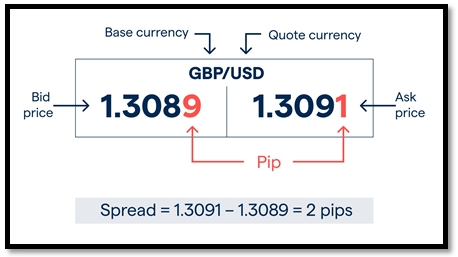

They Must Offer You a Good Spread

You must ensure that the one you choose makes good spreads available to you. The best spreads are the lowest.

However, during your research, do not rely completely on the information you will receive about the broker.

Just because they offer you the lowest spreads does not mean that when you actually register on their platform, you will always benefit from these spreads.

To compare cutting edge Forex Brokers with an easy-to-use interface, fill in your details in our enquiry form, and we will get back at you with up to 4 FREE quotes for you to assess and review

GET FREE QUOTES

They Should be Able to Present You With a Good Variety of Trading Accounts

A good broker should be able to present you with several varieties of trading accounts. These are, for example, STP and ECN accounts or even accounts that can reduce spreads when you make large deposits.

They Must be Able to Let You Choose Your Leverage

Since the trading market is a market that is sometimes traded with leverage, they must be able to let the trader choose his leverage.

In this way, he could have the possibility of managing the leverage positions. Indeed, the leverage allows him to have a greater investment capacity, which is very interesting for the trader.

They Must be Able to Present You With Several Markets

When you are looking for one, take an interest in those who will introduce you to a wide variety of markets. It would be very beneficial for you to be able to invest in several markets at the same time.

This increases the risk of profit at your level. They should be able to offer you markets such as cryptocurrencies, commodities, stocks , ETFs, bonds or indices.

They Must be Able to Offer You a Demo Account if You Are a Beginner

If you are a beginner, you must ensure that your broker offers you a demo account. The demo account will allow you to train in order to gain more experience.

Otherwise, it would be really unfavourable for you to start trading directly and without any experience. This is a very important point if you are a beginner.

They Should be Able to Offer You Training

It is not advisable for them to give advice to traders. However, from time to time he could offer him training in trading. Since the broker is experienced, he could train you so that you do the different operations well.

The training improves the level of the trader. It is especially advantageous for novice traders. If you have chosen a no dealing desk platform, the training will help you make the best choices since the broker will in no way analyse your orders.

READ ALSO: Tips For Choosing Trading Platform. Compare Powerful Forex Trading Platforms In A Few Steps

How To Choose Your Online Broker

Before trading currencies, you need to create an account with a Forex broker. So what are they? In simpler terms, they are a person or a company that buys and sells orders according to the decisions of the trader.

They make money by charging commission or fees for their services. You may feel overwhelmed by the number of them who offer their services online.

Deciding on one requires a bit of research on your part, but the time spent will give you an overview of the services that are available and the fees charged by the different ones.

Is The Forex Broker Regulated?

When selecting a prospective foreign exchange broker, find out which regulatory body it is registered with. The Forex market is labelled as an “unregulated” market, but it is in reality.

So be rigorous, for example in the United Kingdom, a broker must be registered with the FCA (The Financial Conduct Authority. The FCA was made to protect the public against fraud, manipulation and abusive commercial practices

Among the companies registered, look for those that have a clean regulatory record and a solid financial reputation. Stay away from unregulated businesses.

Availability

Another important criterion: Can you communicate with the company by phone, email, chat, etc.? Are the contacts competent and responsive? The quality of support can vary considerably from one broker to another, so be sure to check them before opening an account.

Here is good advice: choose several of them and communicate with their support teams.

How fast are the responses? What is the quality of the responses? Do not hesitate to exclude potential brokers on this item. It often happens that the pre-sale service is much more efficient than the after-sales service. Make sure your money is treated well.

To compare cutting edge Forex Brokers with an easy-to-use interface, fill in your details in our enquiry form, and we will get back at you with up to 4 FREE quotes for you to assess and review

GET FREE QUOTES

Online Trading Platform

Most, if not all of them allow you to trade directly online easily. The backbone of any trading platform is their ordering system. The quality of trading software is important. Always request a demo account before signing up!

Your trading platform should always include:

► The possibility to consult in real time the rate of currencies and exchange rates.

► A summary of accounts showing the current balance, profits and losses realised.

► The ability to offer orders automatically.

Most trading platforms are either based on Java web technology or on a program to be installed on your computer (client side).

If the client to install on your computer makes you lose flexibility because you have to install software as soon as you want to trade it is much more often very powerful programs which offer many more possibilities. Like for example metatrader or even prorealtime.

Usually the downloaded software is faster at runtime. Be careful however of the bone you are using.

Indeed all the software offered by brokers is not necessarily compatible on Mac. So we can never say it enough: always ask for a demo account before going headlong.

Remember That Your Internet Connection Is As Important As Your Choice Of Forex Broker

The Forex market is a fast-changing market and you will need second-to-second precision to make the right decisions. Without a stable broadband connection: no forex trading.

If you don’t have fiber optics or a strong ADSL: don’t think about foreign currency exchange. You also obviously need a good workstation.

If your PC does not allow you to open more than 4 tabs on your browser, you will need to invest in a more powerful PC before even thinking about getting started and choosing one.

Do They Offer Direct Access To The Quotes?

Any self-respecting Forex broker must offer you quotes in real time. It should allow you to quickly enter and exit at the same speed from a position. These are minimum requirements.

Check that your Broker does not charge the software upgrade as an additional charge. These are out-of-date costs and need not be.

Most of them now offer technical analysis software in their trading products (we talked about this above). Check that the integration between the software and the platform is optimal.

Does The Forex Broker Open A Micro Account?

Most of them offer the possibility of opening a micro-account. This opens an account for a few hundred dollars. These micro accounts are a great way to get started and test your business skills and gain experience.

To compare cutting edge Forex Brokers with an easy-to-use interface, fill in your details in our enquiry form, and we will get back at you with up to 4 FREE quotes for you to assess and review

GET FREE QUOTES

Analyse The Offer Of The Forex Broker

Before making your choice, you should carefully consider their features and policies.

These include:

► Currency pairs available – You must confirm that their offer has at least the seven major currencies (AUD, CAD, CHF, EUR, GBP, JPY and USD).

► Transaction/Trade costs – Trade costs are calculated in pips. These differences constitute the spread. These are your fees on foreign exchange brokers.

The lower the number of points required, the greater the profit is for the professional. On average we calculated by performing spread averages on the market that the rate was 3 pips. If you can find 2 pips respecting our other criteria you will be on a competitive offer.

► Margin – Higher the margin requirement (meaning the greater the leverage, the higher the potential profits and losses is high. Margin percentages vary from .25% and more.

Low margin requirements are great when your trades are good, but not so big when you are wrong. Be realistic about margins and never forget the risks that Forex involves.

Preferably start with low leverage as long as you have a small portfolio and that you are still learning.

► Minimum size trading requirement – A lot consisting of 100,000 units is called a standard lot. A lot consisting of 10,000 units is called a “mini” lot.

A batch consisting of 1,000 units is called a “micro” batch. Some of them even offer fractional unit sizes (called irregular lots) that allow you to create the size of your own unit.

► Rollover charges – These are the rollover charges known as rollover charges. They are determined by the difference between the interest rate of the base currency countries and the interest rate of the other country.

The greater the interest rate differential between the two currencies in the currency pair, the greater the reversal load.

► Interest rate margin account – Most brokers pay interest on a merchant’s margin account. Interest rates normally fluctuate with the prevailing national rate.

If you decide to take an extended break from trading, the money will grow on your site.

Keep in mind that most brokers will not allow you to account for your interest if your margin requirement is not at least 2%.

Other Policies (Those Written In Small Print)

Make sure to scrutinise the CGV for “small print”. Brokers can be very inventive on the subject. Finding the right broker is not easy and requires real work on your part. Do not take the first one that looks good to you. Keep watching and trying out different demo accounts.

In Summary

What to look for in an online Forex broker / distributor:

► Low Spreads – In Forex the “spread” is the difference between buying and selling prices of any of the currency pairs .. Lower spreads save you money.

► Account with small minimum openings – For those who are new to currency trading and for those who do not have millions of dollars in venture capital for trading, to be able to open a micro operating account with only $ 250 (we recommend at least $ 1,000 ) is a great feature for new operators.

► Automatic execution of your orders – This is very important when choosing a foreign currency exchange broker. Do not settle with a firm that re-quotes you when you click on a price or a company that allows price slippage ”. This is very important in trading small profits.

► Mapping and technical analysis offered – Choose a broker that gives you access to the best technical mapping and analysis available to active investors. Look for a broker that offers free professional mapping services and allows operators to trade directly on maps.

► Leverage – Can either make you rich or very poor. As an inexperienced trader, you don’t want to take advantage of too much. A rule of thumb is to use no more than 100: 1 leverage for Standard accounts (100k) and 200: 1 (10k) for mini accounts.

At Acorn 2 Oak, we aim to help you navigate through the vast possibilities in the sector. Compare top ranking forex brokers in just a few clicks. Save time and money, as we will provide you with up to 4 FREE no-obligation quotes that match your requirements. The service is completely FREE, and all you need to do is enter your details in the enquiry form.

To compare cutting edge Forex Brokers with an easy-to-use interface, fill in your details in our enquiry form, and we will get back at you with up to 4 FREE quotes for you to assess and review

GET FREE QUOTES