What Is A Managed Forex Account?

Forex managed accounts are professionally operated trading accounts in the foreign exchange market. They are managed by experienced traders or investment firms on behalf of the investor.

Typically, investors authorise the trader to place trades by signing a Limited Power of Attorney (LPOA), ensuring the trader can operate the account without handling withdrawals. Investors retain full ownership and control, with the ability to deposit, withdraw, or close the account at any time.

Managed forex services usually charge performance fees, based on profits earned, and sometimes a fixed administration fee. Increasingly, reputable providers offer verified trading records, regulatory oversight, and risk management practices such as stop-loss limits or drawdown caps.

Exploring Forex Managed Accounts: What You Need to Know

Venturing into the world of forex managed accounts can feel overwhelming, particularly if you are new to this type of alternative asset or simply seeking a deeper understanding before committing your capital.

At its core, the concept is straightforward: select a trusted service, allocate your investment, and allow experienced traders to manage your forex positions professionally. In reality, there’s much more to consider when it comes to finding reputable managers, assessing risk, and protecting your funds.

This guide has been created to answer your key questions clearly and honestly. Having personally invested in four different managed forex services, both within the UK and internationally, I draw upon real-world experience to help you navigate the landscape with confidence.

Whether you are looking for passive income opportunities, ways to diversify your portfolio, or an efficient method to engage in forex trading without day-to-day involvement, you’ll find practical insights throughout.

I hope you find this information valuable as you explore whether managed forex accounts align with your financial goals.

Find out more about copy trading where you can choose the trader to copy the trades from automatically.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

Choosing a Forex Managed Account

Once you have decided to invest in a forex managed account, the next step is choosing a provider that aligns with your risk appetite and investment goals.

Focus on regulated account managers with a proven track record, and take the time to compare key factors such as performance history, fee structures, and drawdown limits.

Step 1. Risk Tolerance

Choosing the right managed forex service is not one-size-fits-all; it depends on several factors such as your risk capacity, investment goals, and time horizon. In recent years, more investors are also considering the role of sustainable investing (ESG) and technology-driven strategies in their decision-making.

Two Key Aspects of Risk Tolerance

► Risk Capacity: This is the objective side of risk tolerance. It refers to your ability to absorb potential losses without affecting your lifestyle or financial security. A young investor with substantial income potential (human capital) has more risk capacity than a retired individual living off fixed income.

► Risk Preference: This is the subjective, emotional side of investing. It reflects how comfortable you are with potential volatility in your portfolio. This is often influenced by past experiences, financial education, and emotional resilience in the face of market downturns.

Determining Your Risk Capacity and Preference

To assess your risk profile, ask yourself the following questions:

► How much volatility can I withstand without compromising my lifestyle or financial goals?

► What level of risk am I comfortable with, and how much stress can I manage during market fluctuations?

Ability to Tolerate Risk (Risk Capacity)

Your risk capacity is influenced by your overall financial situation, including both your wealth (investments, savings) and your human capital (future earning potential). For example, a young, well-educated investor might feel comfortable taking on a higher level of risk because they have the time and earning potential to recover from losses. In contrast, a retired investor may need to adopt a more conservative approach to ensure a steady income stream throughout retirement.

Consider a young investor, £10,000 in hand, ready to take on high-risk investments to grow wealth over the next 40 years. They are well-equipped to handle volatility, knowing they can recover from losses. On the other hand, an investor relying on that £10,000 to cover their living expenses might need a much safer, lower-risk approach.

Willingness to Tolerate Risk (Risk Preference)

Your psychological risk tolerance refers to your emotional reaction to potential losses. This aspect often involves behavioural finance, as research suggests that investors frequently overestimate their ability to handle risk. Think back to the last time you experienced an investment loss—how did you react? If the experience caused significant stress, it might indicate that your psychological risk tolerance is lower than you initially thought.

Be mindful of behavioural biases such as loss aversion, where the pain of a loss feels stronger than the pleasure of a gain. If you find yourself anxious about fluctuations in your portfolio, you might want to reconsider your risk preferences and reduce exposure.

Managing Your Portfolio

Aim to set your portfolio’s risk level at the intersection of both your financial capacity and your psychological comfort. Modern investment tools like robo-advisors and AI-driven risk assessments can help tailor a portfolio to match these factors, ensuring that you are investing in line with both your financial goals and your emotional tolerance for risk.

Understanding the Relationship Between Ability and Willingness to Tolerate Risk

When making investment decisions, it’s crucial to understand two key aspects of risk tolerance: your ability and your willingness to tolerate risk.

Example 1: Ability to Risk

Consider a wealthy investor who has accumulated significant assets. For example, a high-net-worth individual may be comfortable with investing £10,000 in a diversified portfolio, such as an index fund or a managed account. If the investment were to experience a total loss, the investor’s lifestyle would not be significantly affected. However, if the prospect of such a loss causes significant stress or anxiety, even though they can afford the risk, they should consider other investment options.

Example 2: Willingness to Risk

On the other hand, a retiree with a smaller nest egg, living primarily on pension income, might be more hesitant to invest £10,000 in a similar portfolio. While they may have the financial capacity to absorb the loss, the emotional impact and the potential to disrupt their ability to maintain their standard of living would make the risk unappealing. In this case, their willingness to tolerate risk is lower, and they might decide against making such an investment.

Key Point to Remember

When determining your own risk tolerance, it’s essential to consider both your ability and your willingness to bear risk. Risk tolerance is not solely about the financial capacity to absorb losses; it’s equally about how comfortable you feel with the possibility of those losses and how they might affect your goals and emotional well-being.

How to Assess Your Risk Tolerance Today

Modern investors often use risk tolerance questionnaires provided by investment platforms to assess their financial capacity and emotional readiness to take on risk. These assessments may factor in additional considerations such as your investment time horizon, income needs, and personal preferences, including ethical investing (e.g., ESG funds) or alternative investments (like cryptocurrencies).

Ultimately, understanding the balance between your ability and willingness to tolerate risk will help you make informed and appropriate investment choices.

Looking to find the right managed forex account for your needs? Simply click the link below and complete the short form on the next page. You’ll then receive up to four tailored, no-obligation quotes from leading fund managers, helping you compare performance and fees with ease.

Step 2. Managed Forex Account Benefits

Now that you feel comfortable with your risk profile, you can check out a few accounts to see what benefits they can offer you. Before investing some money into a forex managed service, you will want to know about the benefits that they can offer you so that you can weigh them up against the other types of investment.

Capital Protection and High Returns in Forex Managed Accounts

When investing in forex managed accounts, the primary goal is typically capital protection, but let’s not forget the reason why most of us invest: to make money. A well-managed account has the potential to deliver substantial returns over time. In fact, the monthly returns on forex managed accounts can significantly outperform traditional investments, where returns tend to accumulate annually.

Even with a relatively modest starting balance of around £10,000 (or equivalent), investors can typically expect returns between 2% and 10% per month. For those with larger portfolios (in the millions), it’s not unheard of to see annual returns that can exceed 100%. The power of compounding monthly returns can lead to extraordinary growth over the long term.

While eye-catching returns are important, they should not be the sole factor in your decision-making process. It’s crucial to consider the full scope of the offering, which includes factors beyond just the previous couple of years of trading performance.

As previously mentioned, higher returns usually come with higher risk — larger drawdowns and more significant position sizes (larger lot sizes). Additionally, it’s essential to take into account the fees associated with the managed accounts, which can reduce your overall profitability.

Key Considerations for a Successful Investment

Risk-Reward Balance: Higher returns often mean higher risks. Ensure that you’re comfortable with the level of risk you’re taking on and understand the potential drawdowns that could come with greater rewards.

Fees and Charges: Be mindful of management fees, performance fees, and any other costs that may be deducted from your account. These fees can significantly affect your net returns over time.

Transparency and Reporting: Look for managed accounts that offer transparent reporting, including detailed trade history and risk metrics, to help you make an informed decision.

Ultimately, while returns are a major consideration, they need to be balanced with the level of risk you’re willing to take and the fees that could eat into your profits. It’s always wise to conduct thorough due diligence and seek professional advice if necessary.

For example :-

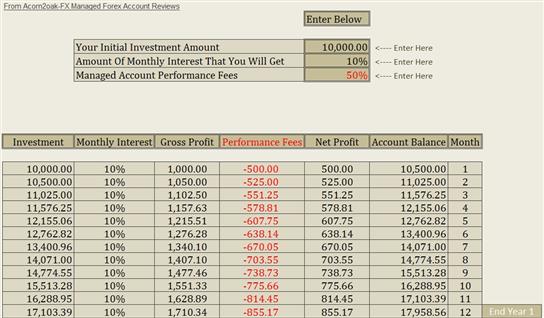

Imagine averaging 10% per month over the last two years. If you had a starting capital of £10,000 and the fees were 50%, you would end up with £17,958.56 at the end of Year 1. Not bad.

However.

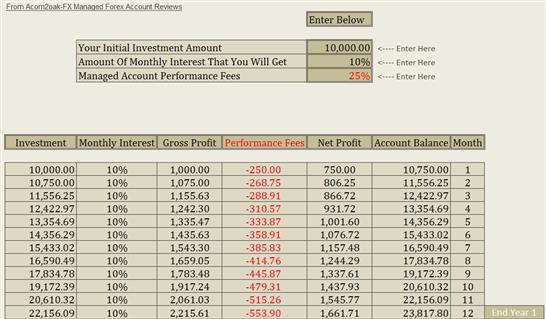

If they were 25% and not 50%, at the end of Year 1, you would have amassed £23,817.80. That’s better.

This amounts to a further 58.59% gain.

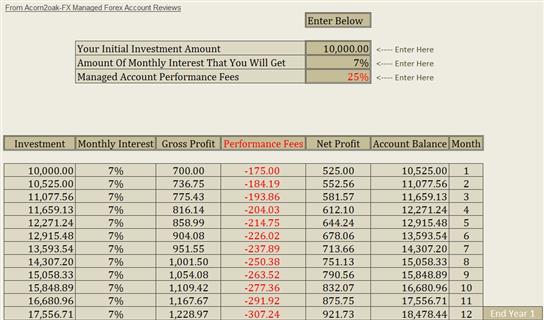

You would be more profitable than the first example if the account was averaging out at lower 7% per month and they were 25%. This would leave you with £18,478.44.

So, by all means try to get the best returns you can BUT take risk and fees into consideration also.

Low Drawdown Limits Matter More Than Ever

When assessing a managed forex account, controlling drawdown is critical. (Drawdown is the reduction from a peak to a trough in the account value during a trading period). Ideally, you want the lowest possible drawdown, even if you have a higher appetite for risk.

A reputable service should clearly state a maximum drawdown limit, for example, 30% or 40%. Once this threshold is reached, the system should either halt new trades or close existing ones to protect your remaining capital. Always confirm these protections with the fund manager before you invest.

Bear in mind, a strict stop-out can feel frustrating if trades would have recovered soon after closure. However, it’s better to preserve your capital than risk a deeper loss. Managing risk consistently over the long term is more important than chasing short-term rebounds.

Some modern services now allow you to customise your own personal drawdown limit through their client dashboards. This added control is a major advantage if you can find a provider offering it.

Look for accounts that match your investment level with a reasonable minimum opening balance.

In recent years, the typical minimum opening balance has reduced significantly, now often starting at £10,000 GBP. Interestingly, it’s not uncommon to see these amounts dropping even further, with £5,000 GBP becoming a standard threshold, and in some cases, even lower minimums are available.

When FX managed accounts were first introduced, they were primarily aimed at large investment firms or institutional investors, with a starting capital requirement often exceeding £100,000 GBP.

Today, however, the rise of online platforms and high-speed internet has made it easier than ever for individual investors to access these types of funds. With this accessibility comes greater demand, leading to increased competition within the market.

Understanding Performance Fees in Investment Management

Performance fees are a common feature in many investment strategies, but they can vary significantly. These fees are typically charged as a percentage of the returns generated by the investment manager above a certain benchmark or target.

From my experience, performance fees range from 25% to 50%, though more often than not, the fees fall within the 25% to 35% range. However, I’ve recently come across an investment with a relatively low fee of 15%, which only recently increased from 10%.

While lower fees are appealing, especially for investors seeking to maximise returns, don’t rule out higher performance fees too quickly. Some investment opportunities with higher fees might deliver exceptional returns and be more suited to certain risk profiles.

For instance, if you have a higher risk tolerance, the potential for greater returns may justify the increased fees.

Naturally, everyone wants to minimise fees, but it’s crucial to assess whether a lower-fee investment aligns with your risk profile and investment goals. Sometimes, it might be necessary to accept a higher performance fee if it means accessing an investment that fits better with your overall strategy.

Be sure to conduct thorough due diligence and continue exploring different options until you find the best fit for your needs.

Profit in Any Market

Profit can be made in whichever direction the market is heading. Whether it is sideways, bullish or bearish, there are trading opportunities and the potential to make money.

Ready to discover which managed forex account suits your investment goals? Follow the link below, provide a few details, and you’ll be matched with up to four top-rated fund managers who will send you personalised, FREE quotes for comparison.

Hands-off Forex Investment: A Modern Approach

Learning how to trade forex can be a time-consuming and intricate journey. For many investors, dedicating hours to mastering the ins and outs of the market, developing a strategy, and executing trades is not appealing.

Even once a strategy is established, forex traders must devote substantial time to constantly monitoring the market, making high-stakes decisions with precision and focus.

An increasingly popular alternative is to invest in a managed forex account, where professionals handle the trading for you.

This approach allows investors to benefit from the potential returns of forex trading without the stress or time commitment of active involvement. With a managed account, you get the advantage of expert knowledge while freeing yourself from the day-to-day responsibility of monitoring trades.

Being a successful forex trader requires emotional detachment, a skill that can take years to develop. Emotional reactions to market movements can cause deviations from a solid strategy, often resulting in losses.

This is why many investors opt for managed accounts or automated trading systems, which eliminate emotional decision-making and allow for a more consistent and disciplined trading approach.

In today’s fast-paced, digital trading landscape, technologies like artificial intelligence (AI) and algorithmic trading are playing an increasingly significant role in managing forex investments.

These innovations not only make the process more efficient but also help reduce the risk of human error, offering investors access to strategies that might otherwise be out of their reach.

Risk Control

A well-managed trading account is considered a low-risk investment, providing consistent returns with limited exposure to losses. Effective risk management is paramount for any successful trader. Leading services often implement a maximum drawdown limit — a safeguard designed to halt trading once losses exceed a predefined threshold. For instance, if the drawdown limit is set at 30%, the account will stop trading if it falls 30% from its highest peak.

The investor’s risk tolerance determines the acceptable drawdown level. Some investors may be comfortable with a 30% drawdown, while others may prefer a more conservative approach. Additionally, traders often set individual trade risk limits — for example, a specific pip value, such as 200 pips — to prevent individual trades from incurring excessive losses.

The top traders typically maintain a high win rate (around 70% to 90%), with an effective trading strategy that manages both the risk-to-reward ratio and trade sizing to ensure long-term profitability. Elite traders may employ advanced techniques such as position sizing algorithms or dynamic risk management to adjust their risk parameters in real time, based on market conditions and the current state of their account.

Your Control Your Account

Your funds will remain in a trading account held in your name, giving you full control over the account. You are free to deposit or withdraw funds at your convenience. Should you wish to close the account, you may do so, provided you have no open trading positions.

The trader’s access is solely for executing trades on your behalf and they cannot withdraw or transfer your funds. In order for the trader to act on your behalf, you will be required to provide them with a Limited Power of Attorney (LPOA), which grants them the authority to manage trades but not access your funds.

Forex Is Difficult to Manipulate

The stock and futures markets can be influenced due to their reliance on centralised exchanges, typically overseen by a single regulatory body. This centralisation allows for the possibility of price manipulation, especially by large institutional traders who can execute high-volume trades that impact market prices.

In contrast, the forex market operates on a decentralised network, with no central exchange, leading to multiple price feeds across different brokers. This decentralisation makes it more competitive among dealers and reduces the influence of any single participant on the price. Moreover, given the immense trading volume in forex, individual investors have a minimal impact on price fluctuations.

Liquidity

Unlike traditional investments, such as long-term fixed deposits or property, where your capital is often locked in for extended periods, trading allows for far greater liquidity.

With trading, whether it’s stocks, forex, or other financial instruments, you can typically close a position and have the funds available in your account within two to three days. This flexibility makes it easier to access your money when you need it most, providing a level of responsiveness that more passive investments can’t match.

Leverage

Leverage refers to the ability to control a larger position in the market using borrowed funds. Different brokerages offer varying levels of leverage. For instance, if a brokerage provides a leverage ratio of 100:1 and you have a deposit of £1,000, you would be able to trade up to £100,000. This offers significant potential to amplify profits, allowing investors to control large sums with relatively small capital.

However, while leverage can greatly increase profits, it also magnifies the risk of losses. If the market moves unfavourably, your losses could exceed your initial deposit, potentially leading to the loss of your entire investment. It’s crucial to understand how leverage works and to manage it responsibly, especially as some brokerages may offer higher leverage ratios, which can increase both risk and reward.

Open 24/7

The forex market operates globally, with key trading hubs in New York, London, Tokyo, and Sydney, making it possible to trade 24 hours a day, five days a week.

Thanks to advancements in digital trading platforms and automated systems, currency trading has become more accessible than ever, with market participants from all over the world engaging in real-time, round-the-clock transactions.

Step 3. Due Diligence

Once you’ve assessed your risk profile and are confident about the benefits being offered, the next crucial step is selecting a reputable and reliable firm to manage your investment.

The last thing you want is to lose your hard-earned money to fraudsters, and unfortunately, they’re still prevalent in the industry. That’s why conducting thorough due diligence on the company you’re considering investing with is absolutely vital.

Investing in the forex market involves varying degrees of risk. While some of these risks are inherent, many can be mitigated by doing comprehensive research on the firms you’re considering.

The majority of scammers can be identified with good research. However, it’s also important to keep in mind that even some legitimate firms may not always follow their stated policies, or might experience operational issues that affect their reliability.

I have been stung by one that had a drawdown limit of 15% but went on to lose over 98% of my money. You can read more about it here vista-fx-trading-group-review-big-no-no-for-me.

It’s important to note that just because a managed account doesn’t meet all of the recommended criteria, it doesn’t automatically mean that it’s untrustworthy or unreliable.

However, the more thorough the due diligence you carry out, the better your chances of avoiding a poor investment outcome. The primary goal is to protect your initial capital, and a reputable asset management firm will prioritise this objective.

There are several ways you can thoroughly vet an opportunity to ensure it aligns with your financial goals and risk tolerance.

Want a simple way to compare fees and returns from trusted managed forex account providers? Complete the form via the link below and receive up to four bespoke quotes from some of the best fund managers available, tailored to meet your investment preferences.

3rd Party Audit

To begin, it’s important to verify whether the company has an independently conducted audit report for its financial results.

A third-party audit is an official statement from an external, independent accountancy firm, confirming that the company’s financial results and information are accurate and reliable.

This audit report may be available on the company’s website. If not, you can reach out to them directly to inquire about obtaining a copy.

If the company provides an audit report, you can further verify its authenticity by researching the accountancy firm involved. Contact the firm directly to confirm that they have indeed conducted the audit.

Are They Regulated

When considering a forex broker, one of the first things to check is whether they are regulated by a recognised authority, such as the FCA (Financial Conduct Authority) in the UK, or other reputable bodies worldwide.

This information is often available on their website, but if you can’t find it, don’t hesitate to reach out and ask. Reputable brokers should be transparent about their regulatory status.

If they claim to be regulated, it’s important to verify this directly with the relevant authority. For example, you could contact the FCA in the UK to confirm their status and ensure they are in good standing. Regulatory bodies maintain public registers that allow you to check this information easily.

While it is not mandatory for forex brokers to be regulated, choosing an unregulated broker can pose significant risks. Regulation ensures a certain level of oversight and consumer protection, which adds credibility and security to their operations.

If a broker is not regulated, you may want to consider why they’ve chosen to forgo this important step. Regulation often demonstrates a commitment to ethical practices and a higher standard of business integrity.

Trading History

One effective way to evaluate a forex account manager is by requesting proof of their trading history over the last two years. If they’ve demonstrated consistent profitability during that period, it’s reasonable to assume they possess the skills and experience necessary to manage an account effectively.

However, it’s crucial to remember that past performance is not an indicator of future results. Market conditions evolve, and even successful traders can face downturns, so it’s always important to assess risk management strategies in addition to historical profits.

Online Analytical Tools

Depending on the trading platform used, such as MetaTrader 4 (MT4), you can trade online using various analytical tools like Myfxbook, which tracks and records historical data. You can also request live trading accounts from forex account management teams, which will include records of all executed trades.

Online analytical tools often offer a feature to verify the authenticity of trading results. This helps to ensure that the data has not been tampered with, protecting you from potential scammers, who, unfortunately, are still prevalent in the market.

Be sure to check the verification process for each tool, as it can vary depending on the platform.

Is The Broker Regulated

When choosing a broker, one crucial aspect to research is whether or not they are regulated.

In today’s highly competitive trading landscape, most brokers will be regulated by recognised financial authorities, as regulation is a legal requirement in many jurisdictions. This gives traders peace of mind that the broker is subject to oversight, ensuring they follow strict financial standards.

However, it’s important to note that while regulation is a good indicator of reliability, some small or new brokers may still operate without formal regulation.

These brokers may not have the resources to obtain or maintain regulation, but they could still be legitimate. Nonetheless, unregulated brokers carry higher risks, and it’s wise to approach them with caution.

To confirm whether a broker is regulated, check their website—reputable brokers typically display regulatory information prominently. If you can’t find it, don’t hesitate to reach out to the broker directly and ask for their regulatory details.

Once you have this information, you can verify it by contacting the relevant regulatory body. Most financial authorities provide online tools or customer support to confirm the authenticity of a broker’s regulatory status.

Why Does Regulation Matter?

Regulation ensures that brokers comply with stringent financial standards and guidelines, safeguarding clients from fraud, misconduct, or financial mismanagement. Regulated brokers are also obligated to segregate client funds and maintain a high level of transparency in their operations, significantly reducing risk for traders.

With the surge of online trading platforms and the increasing number of brokers entering the market, understanding the regulatory status of a broker has become more crucial than ever. In addition to financial regulation, many brokers are now subject to cybersecurity requirements and data protection laws, addressing the rise of digital threats and ensuring secure, trustworthy trading environments.

Before engaging with a broker, traders should verify that the platform is authorised by reputable regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the European Securities and Markets Authority (ESMA) within the EU. This is essential to ensure safe, compliant trading practices in a rapidly evolving market.

The leading brokers are splattered all over the internet so you can usually determine the reliable ones.

Other Diligence

If the above five criteria are passed, then you will reduce your risk of being scammed by a massive extent.

There are other things you could do such as checking out forex forums such as forexfactory.com or forexpeacearmy.com and raise the question on those.

Also speaking to the company and asking them about the above groundwork will give you an idea if they are the real deal or not. You will soon find the ones to steer clear of when they avoid your questions.

How do Forex Managed Accounts Work?

Signing Up

After defining your risk profile, exploring opportunities and carrying out thorough research, you should be ready to commit to the one that aligns best with your goals.

Setting up an account is usually a straightforward process, whichever platform or opportunity you choose. Although the exact steps may vary slightly, most platforms offer clear guidance throughout the registration and onboarding process.

Generally, you can expect something along the following lines –

Start by visiting their website and locating the account opening section. You will need to complete the online application form with your personal details.

If you provide your telephone number, a representative may contact you; otherwise, instructions for the next steps will be sent by email or through their secure client portal.

You should then receive a contract outlining the terms and conditions, including details such as the fee structure and authorisation for withdrawal at the end of the agreed period. Take the time to read this document carefully. If you are happy with the terms, you will be asked to sign and return it.

Most companies now use secure digital signature platforms such as DocuSign or Adobe Sign, meaning there is no longer any need to print, sign and scan documents manually.

You may wish to have a solicitor review the contract before proceeding to ensure that everything is in order.

Typically, you will then be instructed to open a trading account with the broker you have already researched. Go to the broker’s account opening page and complete the required application.

You should receive confirmation that your application has been received. Once it has been reviewed and approved, the broker will contact you with further instructions.

At this point, you will be asked to verify your identity. Electronic identity verification (eKYC) is now standard practice, with most brokers using apps or secure online portals to complete this process instantly.

You will usually be required to upload a form of photo ID, such as a passport or driving licence, along with proof of your residential address, such as a recent utility bill or bank statement.

Once your identity has been verified, the broker will issue you with an LPOA (Limited Power of Attorney) form. Like the contract, this is typically completed online via a secure digital signature platform.

An LPOA, (Limited Power of Attorney) is a document that you send to the broker that enables the trader to access your trading account to conduct market trading activity ONLY.

Limited Power of Attorney (LPOA) and Fund Access

When granting a Limited Power of Attorney (LPOA) to a managed account provider, it’s crucial to understand the scope of authority you’re assigning. Typically, the LPOA permits the provider to execute trades on your behalf but does not allow them to withdraw funds or alter account details. Always review the LPOA document carefully to ensure it aligns with your intentions.

Account Setup via Managed Account Providers

In some cases, managed account providers facilitate the account setup process with brokers. This means you might submit your identification documents and signed LPOA directly to the managed account provider, who then liaises with the broker to complete the administrative tasks. Ensure that any third-party you engage with is authorised and regulated by the Financial Conduct Authority (FCA) to safeguard your interests.

Account Activation and Funding

Once your account is approved, you’ll receive confirmation from both the broker and the managed account provider. At this stage, you can fund your account using various methods accepted by the broker, such as bank transfers, debit cards, or other electronic payment systems. Be aware of any associated fees and processing times for each funding method.

Trading Platform Access

The broker or managed account provider will provide instructions for downloading and installing the trading platform used for managing your investments. You’ll receive your login credentials, including a username and password, to access the platform. Ensure you keep this information secure and consider enabling two-factor authentication if available for added security.

Compliance with KYC and AML Regulations

As part of the Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations enforced by the FCA, you’ll need to provide:

Proof of Identity: Valid passport, driver’s licence, or national ID card.

KYC Hub

Proof of Address: Recent utility bill, bank statement, or council tax bill (dated within the last three months).

These measures are in place to verify your identity and prevent financial crimes. Ensure all documents are clear and legible to avoid delays in the verification process.

To explore your options and compare performance results and charges across leading managed forex accounts, follow the link below. After filling out a brief form, you’ll get up to four FREE personalised quotes from fund managers who best align with your needs.

Commencement of Trading

Once your account is funded, the trading entity can initiate transactions on your behalf. It’s advisable to maintain regular communication with your account manager or adviser to stay informed about trading activities and strategies.

Monthly Trading Statements

At the conclusion of each trading period, typically monthly, you will receive a comprehensive trading statement from your broker.

This document will detail:

Executed Trades: A record of all completed transactions.

Open Positions: Any trades that remain active.

Pending Orders: Orders that have been placed but not yet executed.

Performance Summary: An overview of profits, losses, and the current account balance.

These statements are crucial for monitoring your investment performance and ensuring transparency.

Understanding the High-Water Mark Principle

The high-water mark (HWM) is a standard mechanism in performance-based fee structures, ensuring that fund managers are compensated only when the fund’s value exceeds its previous peak. Key aspects include:

Fee Calculation: Performance fees are applied solely to gains that surpass the previous HWM, preventing fees on recovered losses.

Reset Periods: Some arrangements may include periodic resets of the HWM, such as annually, to align with specific investment strategies.

Loss Carryforward: In cases where losses occur, they must be recouped before performance fees are applicable again.

This structure aligns the interests of fund managers with those of investors, promoting responsible and performance-driven management.

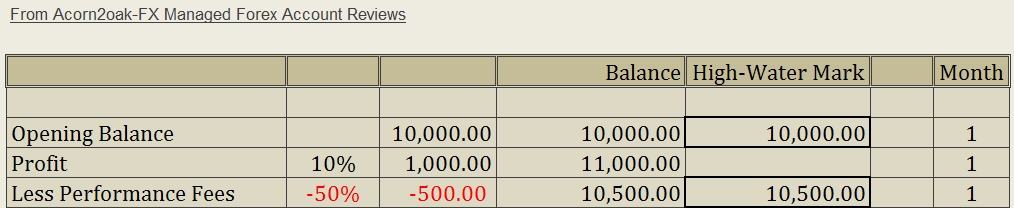

Let me give you an example.

Say you opened a new trading account and the fees were 50% and you put in an initial deposit of £10,000.

During the period (1) it attained a respectable 10% gain. This equates to a monetary gross gain of £1,000.

The managed forex account company deducts their 50% fee which amounts to £500.

This leaves you with a net gain of £500.

It has now created a new high-water mark which is £10,500 made up from your investment of £10,000 plus the monthly net return of £500.

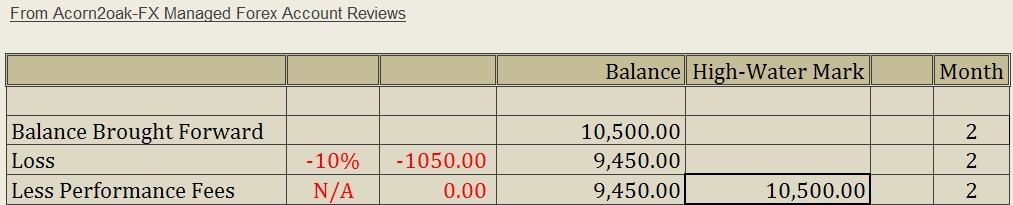

Imagine the next period (2) produced a 10% loss, the equivalent of £1,050.

The balance of your account would be £9,450. You would have nothing deducted because your balance is less than the high-water mark of £10,500.

Your high-water mark would still be £10,500.

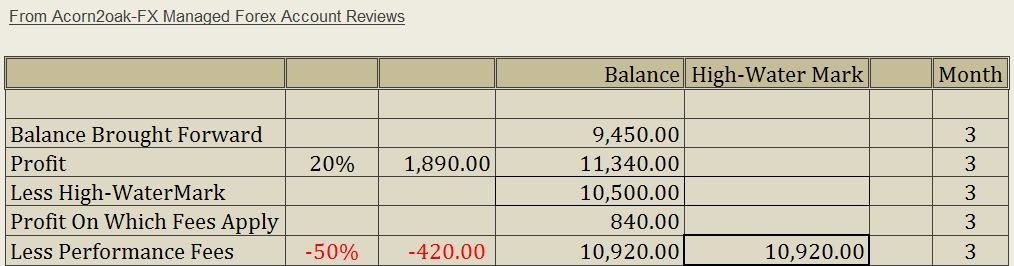

In month 3 they produced a superb 20% return which equates to £1,890.

This takes your balance up to £11,340.

You don’t pay fees on the total yield of £1,890. You pay them on the difference between your new account balance of £11,340 minus the previous high-water mark of £10,500.

This amount works out at £840 and 50% costs come to £420.

You end up with a new balance and high-water mark of £10,920. This is made up from your previous balance of £9,450 plus £1,890 yield less £420 charges.

Only when the new high-water mark of £10,920 is exceeded will anything be deducted, and so on.

FAQs

There are many questions about the account that your trading funds are held in and I will try to cover those in this section.

► When you opened your account, it was in your name and your name alone (unless you opened it with a partner), so you own it and have total control over it.

► You are free to withdraw money at any time and this is normally done without expense to yourself. You can top it up whenever you want to add to it.

► When you want to withdraw cash, you will only be able to draw them out if they aren’t still working orders and involved in a trade. The order will have to be closed.

► You can close the account whenever you want, as long as all positions are closed.

► To add and withdraw to it, there will be a specific page dedicated to this on the broker’s website. It is a straightforward transaction, similar to any online banking transaction. All of the instructions are there anyhow to help you out, as well as customer support.

► The forex account manager nor the trader have access to your funds, apart from what you have signed up for.

► The forex managed account team can withdraw the agreed performance fees at the end of the trading period as per the contract when you signed up.

► They have access to your finances solely for the purpose of trading as per the LPOA that you signed previously.

► There are quite a few different trading platforms that different brokers use. Probably the most commonly used is MT4 (MetaTrader 4).

► These are downloaded onto your computer. You will have access to all of the activity that occurs on your account.

► Once finances are credited, then they can start trading for you on your behalf and you will be able to see it in action.

► Also available are all of the reports that you may want to see such as historic trades.

► You will not have access to the platform to place any transactions for yourself.

Managed Forex Accounts vs. Copy Trading

When researching managed Forex accounts, you may come across a lot of content related to Forex copy trading. While both options involve delegating trading decisions to others, there are key differences between the two that are important to understand.

Managed Forex Accounts

In a managed Forex account, a professional manager or firm handles all trading decisions on your behalf, tailoring the strategy to your specific investment goals, risk tolerance, and market conditions. The manager will execute trades, and you generally won’t have any direct involvement in the day-to-day decisions. Managed accounts often come with fees based on performance or a flat management fee. These accounts are ideal for investors who want hands-off exposure to the Forex market.

Forex Copy Trading

On the other hand, Forex copy trading allows you to select a trader or strategy to follow, and your account will automatically copy their trades in real-time. You retain control over your account and can stop copying a trader at any time. Copy trading typically involves lower fees or no fees at all compared to traditional managed accounts, and it offers greater transparency as you can see the exact trades being copied.

Why the Confusion?

Many Forex brokers now promote copy trading as an alternative to traditional managed Forex accounts. This is because copy trading offers a more accessible, flexible way for individuals to participate in Forex trading with less involvement and often at a lower cost. As a result, copy trading has become a popular option for investors who want to leverage the expertise of others without fully handing over control of their account.

Great content on managed Forex accounts!

Thank you, Martin!