What Is A Managed Forex Account?

Forex managed accounts are foreign currency exchange trading accounts that are operated by professional traders and are administered by a forex account management service on behalf of the investor. The management service charge performance fees and sometimes an administration fee for their provision. The client issues the forex broker with an LPOA (Limited Power Of Attorney) to allow the trader to carry out trading. The client has complete control of their account and can deposit and withdraw funds, and close it when they wish.

Introduction

If you are new to the alternative investment of forex managed accounts or even if you just want to discover a bit more about them before investing in them, you may be finding that it can be quite a daunting job.

The concept is simple enough, locate a service, hand over your investment, let the traders’ buy and sell for you, and then you reap the rewards.

Of course, it is a lot more complex than that.

This webpage is designed to help you discover the answers to your questions. I have invested in four up to this point, in the UK and overseas, so I am quite experienced with them. I have written down everything that I know about them in the article below.

I hope that you find it useful.

Find out more about copy trading where you can choose the trader to copy the trades from automatically.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

Choosing a Forex Managed Account

After you have made the decision to invest in one of the top 10 forex managed accounts, you are going to have to unearth one that fits your needs. You will need to think about your tolerance to risk, the benefits that they offer and then do your homework on them.

Step 1. Risk Tolerance

The managed forex service which is best for you depends on many factors, including the level of risk you can tolerate. The best one for you also depends on factors like your investment goals and time horizon.

The Two Aspects of Risk Tolerance

If your risk tolerance is low, you’ll likely choose a safer portfolio with lower return potential. If you have a high-risk tolerance, you’ll likely choose a riskier portfolio with greater return potential.

To find out your risk tolerance, answer the following questions:

► How much risk can you handle?

► What level of risk do you want to manage?

Ability to Tolerate Risk

Your ability to tolerate risk, also called financial risk tolerance, is your ability to handle an investment loss. If your investments are so risky that you would have to reduce your standard of living in the event of a loss, you may be taking too much risk.

Your ability to tolerate risk depends on your wealth. Wealth refers to both your financial wealth (investments and savings) and your human capital, in respect of your ability to earn employment income. This income can help you offset investment losses. High net worth investors can generally take on more financial risk.

You want your portfolio to be efficient, i.e. you want the best average return account whilst considering the highest level of risk you are willing to accept.

For instance :

A young, educated investor with no debt expects to work for 40 years before retiring. She has the time and the human capital resources needed to compensate for the losses. So she feels comfortable investing

£10,000 in a portfolio with a high level of risk.

A retired investor has a monthly income budget for his expenses. Financially, he can’t afford to lose £10,000 without risking the monthly income he needs to cover his expenditure. He does not have the time or the human capital that the young investor has to recoup the losses.

Willingness to Tolerate Risk

Your willingness to tolerate risk, also called psychological risk tolerance, is the emotional aspect of investing. If you are worried about the level of risk in your portfolio, you may have accepted more risk than you are willing to tolerate. To ease your stress, you might consider reducing the risk level of your account.

It’s easy to over estimate your willingness to tolerate risk. Research has shown that an investor’s attitude and behaviour should not be over estimated, when it comes to risk-taking.

Behaviour is more influenced by past investment experience and beliefs about the future. Think about the last time you dealt with an investment loss: how did you react? If you had difficulty accepting this loss, consider reducing the risk level of your portfolio.

Set your portfolio risk at the lowest level of your ability and willingness to tolerate risk.

Relationship Between Ability and Willingness to Tolerate Risk

You should consider these two elements of risk tolerance before making an investment decision.

For instance :

A wealthy female investor can afford to risk £10,000 by investing in a managed forex account. Even if the investment loses all of its value, her standard of living will remain the same. However, if the idea of losing this money worries her, she should refrain from investing.

A retiree with some savings and low pension income is willing to take the risk of investing £10,000 in a managed account. A loss of money, however, would mean that he could no longer maintain his current standard of living. He cannot tolerate the loss financially; he should therefore, not make the investment.

Your risk tolerance is just one factor to consider when choosing your account.

Point to Remember

To determine your level of risk tolerance, consider both your ability and your willingness to tolerate risk.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

Step 2. Managed Forex Account Benefits

Now that you feel comfortable with your risk profile, you can check out a few accounts to see what benefits they can offer you. Before investing some money into a forex managed service, you will want to know about the benefits that they can offer you so that you can weigh them up against the other types of investment.

High Returns

First and foremost we want our capital protected but obviously the reason that you and I want to invest in the best performing forex managed accounts is to make money. A well-run account can make you a lot of money over time. The returns that you can achieve every month far outperform what most traditional investments make every year.

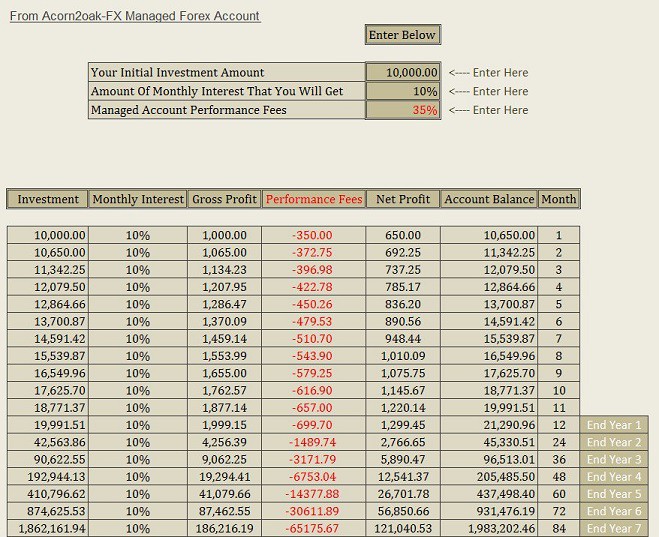

Even starting with a minimum account opening balance of usually $10,000, you could expect anything from 2% to 10% or more every month. (Those investors with millions to invest can expect to receive hundreds of per cent profit every year). Even if the average returns were 5% per month, the compounding effect over time is astonishing.

Great returns are what we want but you will have to consider the overall package, rather than base your decision purely on what the previous two years trading statements say that we could potentially make.

As I said earlier, the greater returns are generally made when you take on more risk, greater drawdowns and larger lots. Also, think about the fees that are deducted.

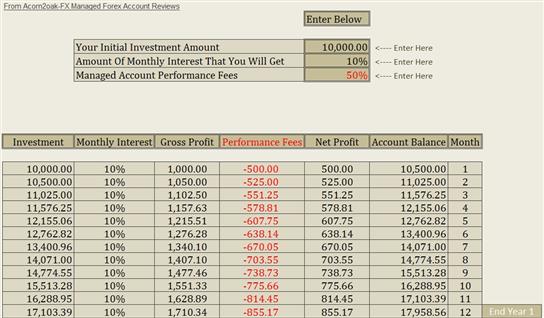

For example :-

Imagine averaging 10% per month over the last two years. If you had a starting capital of £10,000 and the fees were 50%, you would end up with £17,958.56 at the end of Year 1. Not bad.

However.

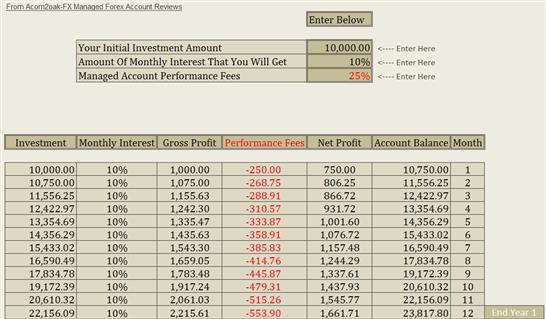

If they were 25% and not 50%, at the end of Year 1, you would have amassed £23,817.80. That’s better.

This amounts to a further 58.59% gain.

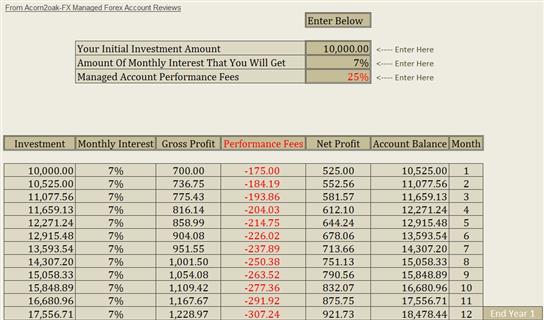

You would be more profitable than the first example if the account was averaging out at lower 7% per month and they were 25%. This would leave you with £18,478.44.

So, by all means try to get the best returns you can BUT take risk and fees into consideration also.

Low Drawdown Limit

You will have addressed this issue as you were deciding on your risk tolerance. Ideally you will want as low a drawdown as possible, even for a high risk profile.

Forex managed accounts will, or should, have a drawdown limit, for example 40%. This means that when it reaches the drawdown limit of 40% it will stop opening new positions or it will close out all of the open ones. You will need to confirm this with the forex account manager.

It is a difficult decision because if all the positions were closed at 40% and then soon after the trades changed direction and went on to win a big returns, you will be quite unhappy I suspect. However, if they went on to lose another 40%, you would be pretty pleased.

There are those now where you can set your own drawdown limit so this is a great option if you can locate one.

Low Starting Capital Needed

Look out for accounts that have a minimum opening amount requirement that fits in with your investment amount.

These days, the normal opening amount has come down to £10,000 GBP. In fact, I have seen it decreasing further and £5,000 GBP is becoming increasingly more common, in some cases even less than this.

When these FX managed accounts first started, they normally were only available to large investment companies or groups and weren’t available to individual investors, and the starting capital requirement was upwards of £100,000 GBP.

Nowadays however, with the advent of the internet and fast broadband connections, it has made it really easy to open up a fund. With ease comes popularity and with popularity comes increased competition for business.

Low Performance Fees

The management will deduct a performance fee for their services, and they vary considerably. I have paid from 25% up to 50%. They that are most commonly charged are 25% to 35% although I have my eye on one at the moment that has a low fee of only 15%, and that has only recently gone up from 10%.

Don’t dismiss the higher charges out of hand though because they could have some exceptional returns and they may suit you better, for example if have a lower risk profile.

Obviously I would want to choose an account with as lower a fee as I could get but if it doesn’t fit in with your risk profile and due diligence, then you may have to settle for a higher fee. Keep looking around until you get what you want.

Profit in Any Market

Profit can be made in whichever direction the market is heading. Whether it is sideways, bullish or bearish, there are trading opportunities and the potential to make money.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

Hands-off Investment

Learning to trade forex is normally a long and complex process. Many investors don’t want to spend hours of their time learning all of the specifics and cultivating a strategy. Also, when a strategy is developed, a lot of time has to be dedicated to trading unremittingly with high attention to detail.

A forex account that is managed and traded for you will provide the investor with an investment that leaves them free of any trading responsibilities but with the benefit of high returns. Being a successful trader means emotional detachment, and that can take a long time. Having feelings and reactions to trades can mean that you will deviate from your overall strategy, and that may leave you open to losing in the long term.

Risk Control

A quality account that is run well is a low-risk investment. Risk management is the main concern for any top trader. Leading services will have a maximum drawdown limit. This limit will stop any trading beyond what the limit is set at. If the drawdown limit is set at 30%, then the account drops by 30% from its highest peak, then the account will stop trading. It is up to the investor’s risk profile as to how much drawdown they can handle. Also, traders may also have individual risk limits for every trade. For, e.g. 200 pips.

This will stop individual trades from losing too much. Good traders will have a winning percentage of trades in the region of 70% or so. The best traders may have a 90% winning trade percentage.

Your Control Your Account

Your funds will be in a trading account that is in your name, so you have total control of it, apart from the trading aspect. You can add funds and withdraw funds whenever you like. You can close the account if you feel the need to as long as you have no trading positions that are still open. The trader has access to your account purely to make the trades for you. They can’t withdraw your funds. For them to be able to trade on your behalf, you will have to give them an LPOA (Limited Power of Attorney).

Forex Is Difficult to Manipulate

The stock and futures markets can be manipulated basically because they are situated in a centralized exchange that is run by one regulator. Also, large traders can alter prices by trading high volumes. Forex is a decentralized market with no single price therefore it is far more competitive amongst the dealers. Also, because the trading volume is so vast, individual investors have very little impact on the price.

Liquidity

Many other investments such as long term deposit plans and property mean that your money is tied up for a long time. You won’t be able to get your hands on the cash immediately if you need it. From being in a trade, you would be able to close the trade to having the funds in your personal bank account in a matter of two to three days.

Leverage

Leverage is the degree that an investor can take advantage of borrowed funds. Different brokerages will have different leverage. If a brokerage has a leverage of 100:1 and you had a deposit of $1000 dollars, you would be able to trade $100,000 dollars. It possesses an enormous potential that enables you to control a lot of money that can make you very wealthy. However, it can magnify losses respectively.

Open 24/7

The forex market is traded all around the world through New York, London, Tokyo and Sydney, and it is, therefore, possible to trade 24 hours a day.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

Step 3. Due Diligence

Now that you feel comfortable with your risk profile and you are happy with the benefits on offer, the crucial part is choosing a trustworthy and dependable firm to invest your money with.

The last thing you want to do is lose your money to a bunch of scammers, and there are many about. So doing your homework on the account you feel is right for you, is essential.

Investing in the forex market carries degrees of risk and some of those risks you can bring down to a minimum by conducting quality homework on the companies.

You can normally wheedle out the scammers by doing this. What you can’t legislate for are those that don’t adhere to their policies.

I have been stung by one that had a drawdown limit of 15% but went on to lose over 98% of my money. You can read more about it here vista-fx-trading-group-review-big-no-no-for-me.

I have to point out that just because a managed account doesn’t pass all of the recommended criteria, it doesn’t mean to say that they are untrustworthy and unreliable.

It’s just that the more due diligence that you conduct, the greater the chance that your investment will not be a disaster. The main aim is NOT to lose your initial deposit and a quality management company will have this as its main objective.

There are a few ways that you do your homework on a opportunity.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

3rd Party Audit

First of all you can do an investigation to see if the company has an independently verified audit report for its results.

This is a statement of trading performance from an autonomous 3rd party accountancy firm that states that the results and information are genuine and correct.

This information may be available on the website, or if not, you can contact them to see if they have one for you to see.

If they have, you can go one stage further and do your homework on the accountancy firm and then contact them to confirm the 3rd party audit.

Are They Regulated

Secondly, you can check to see if they are regulated in the forex market with the relevant regulatory body such as the FCA (Financial Conduct Authority) in the UK.

Once again, this information may be available on their website. If it isn’t, get in touch with them and ask them if they are regulated.

If they are, the next step would be to get in touch with the regulatory body like the FCA UK for example, and ask them to confirm that they are actually regulated with them and if they are in good standing.

They can trade without being regulated as it isn’t compulsory, however, you have to ask yourself why they wouldn’t get regulated because it means that they are serious about their business and it adds another level of security and legitimacy.

Trading History

The third way to do a check is to ask the forex account manager for proof of the trading history for at least the previous two years.

If they have been profitable for that amount of time then you can more or less accept that they are a worthy trader.

Bear in mind that past results are no guarantee of future achievement, just an indication.

Online Analytical Tools

Depending on which trading platform they use, such as MT4 (MetaTrader 4), you could do it online with the help of various analytical tools such as myfxbook.com that has all historical data recorded, or can ask for actual trading accounts from the forex account management team with all of the trades on them.

With the online analytical tools, you can also check to see if the trading results are verified.

This means that they have not been manipulated by scammers. Yes they get everywhere. You will need to check how to do this on the website because each analytical tool does it differently.

Is The Broker Regulated

Another bit of research you can do is check to see if the broker that the trader uses is regulated.

The truth is that 99% of brokers will be regulated because it is a requirement, and also the trader will want to know that they are regulated also.

The unregulated small brokers will not last long in this business because it is highly competitive.

Once again, to check if they are regulated, have a look on their website as they will want to keen to reveal this information.

If you can’t locate the information, you could always get in contact with them to ask them. When you have the regulatory details, you can contact the regulatory body and ask for confirmation if the details are genuine.

The leading brokers are splattered all over the internet so you can usually determine the reliable ones.

Other Diligence

If the above five criteria are passed, then you will reduce your risk of being scammed by a massive extent.

There are other things you could do such as checking out forex forums such as forexfactory.com or forexpeacearmy.com and raise the question on those.

Also speaking to the company and asking them about the above groundwork will give you an idea if they are the real deal or not. You will soon find the ones to steer clear of when they avoid your questions.

How do Forex Managed Accounts Work?

Signing Up

Once you have defined your risk profile, checked out some opportunities and done your research, you should have come to a decision about which opportunity that you want to go with.

Signing up to an account is very similar whichever opportunity you have opted for. It is basically the same process but with slight variations. It is self-explanatory really and they will guide you through it.

It goes something like this.

First of all you will need to go to their website and look for the account opening page where you need to fill out the form with your details.

If you leave your phone number, they may call you otherwise they will send you an email with the instructions of what to do next.

You should receive a contract to sign to agree to the terms and conditions such as the amount of the fee and the fact that they can withdraw it at the end of the period. Have a thorough read through it and if you agree to it, then sign it and return it.

You may want a lawyer to read through it to see if all is as it should be.

Normally, you will be instructed to open a trading account with the broker that you did due diligence on earlier. Go to the brokers account opening page and fill out your details.

You will get an email saying they have received your application and that when they approve it, they will get back in touch with you.

After the brokers approve your application, they will ask you to send over some identification, usually some photo id such as a scanned passport or driving licence, along with a utility bill with your current address on it.

Upon receiving proof of who you are, you will receive another email from the brokers which has an LPOA, (Limited Power of Attorney) on it, typically in the form of an attachment to print, fill out and return by email, or it may be done online using an electronic signature verification.

An LPOA, (Limited Power of Attorney) is a document that you send to the broker that enables the trader to access your trading account to conduct market trading activity ONLY.

They will have no access to your funds for any other purpose such as withdrawing monies and changing account details.

Sometimes, the above dealings with the brokers is carried out through the FX managed account company so you would be sending your identification and LPOA to them and they will sort out some of the administration with the brokers.

You will receive an email from the brokers and also the team saying that your account is activated and that you can add cash whenever you wish. There are many ways in which to fund it as all methods of payment are acceptable.

On one of the previous emails from the broker or the manager, you should have had instructions to download the trading platform that the broker uses.

If not, you will be sent instructions in another email shortly. You will receive your login details and password also.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

Trading

After your account has been credited, they are able to start trading for you. Well there is not a lot you can do apart from letting them get on with their job.

End of Month

Once the last trading day of the period has ended, you will be sent a trading statement from the broker that contains open and closed transactions, working orders and your trading summary with all of the amounts won and lost and current balance.

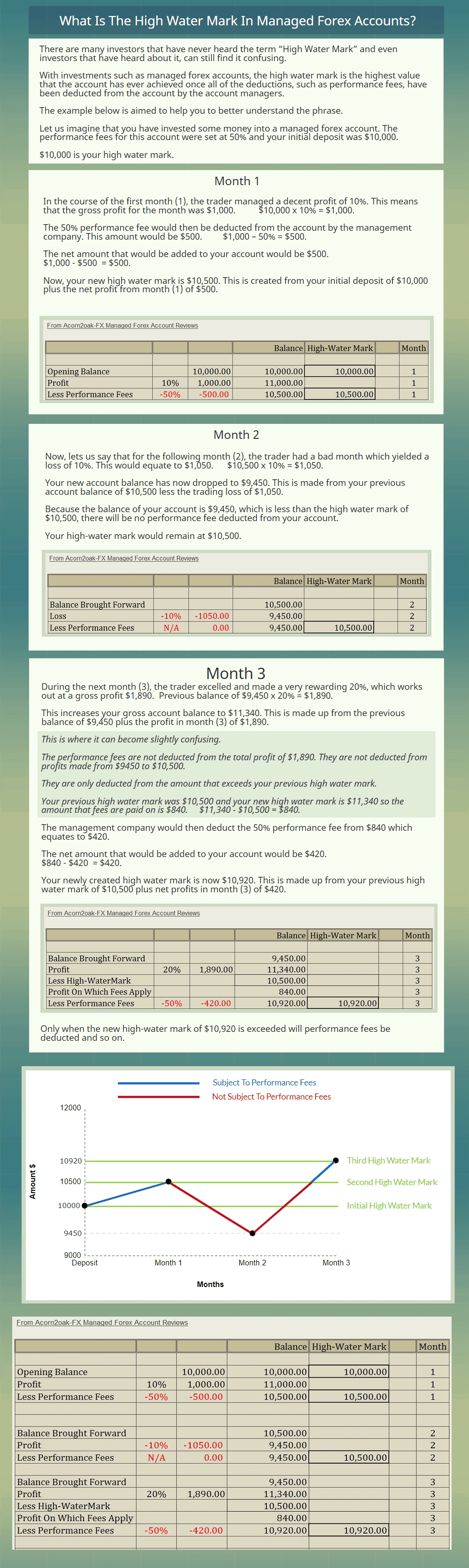

If your funds have exceeded the high-water mark, the fees will be deducted from the returns. They are only subtracted from the returns above the high-water mark.

What is the High-Water Mark?

You may well ask.

A high-water mark is the most amount of money that your account has ever reached after any performance related costs have been subtracted from by the FX managed account company.

Let me give you an example.

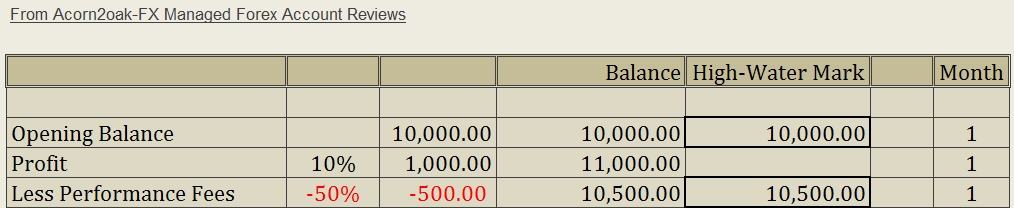

Say you opened a new trading account and the fees were 50% and you put in an initial deposit of £10,000.

During the period (1) it attained a respectable 10% gain. This equates to a monetary gross gain of £1,000.

The managed forex account company deducts their 50% fee which amounts to £500.

This leaves you with a net gain of £500.

It has now created a new high-water mark which is £10,500 made up from your investment of £10,000 plus the monthly net return of £500.

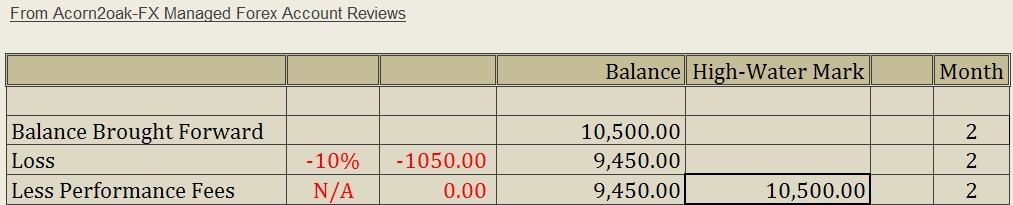

Imagine the next period (2) produced a 10% loss, the equivalent of £1,050.

The balance of your account would be £9,450. You would have nothing deducted because your balance is less than the high-water mark of £10,500.

Your high-water mark would still be £10,500.

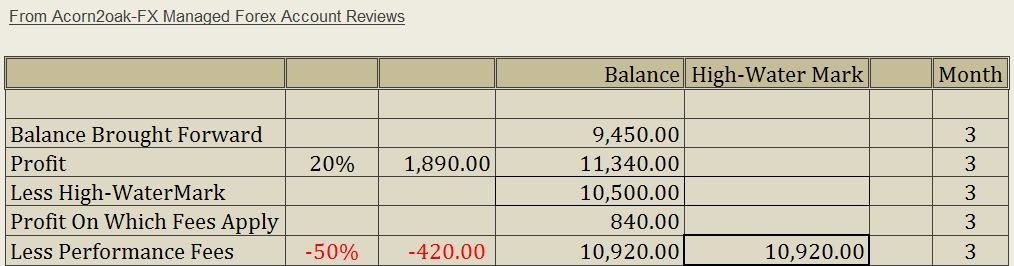

In month 3 they produced a superb 20% return which equates to £1,890.

This takes your balance up to £11,340.

You don’t pay fees on the total yield of £1,890. You pay them on the difference between your new account balance of £11,340 minus the previous high-water mark of £10,500.

This amount works out at £840 and 50% costs come to £420.

You end up with a new balance and high-water mark of £10,920. This is made up from your previous balance of £9,450 plus £1,890 yield less £420 charges.

Only when the new high-water mark of £10,920 is exceeded will anything be deducted, and so on.

Your Managed Forex Trading Account

There are many questions about the account that your trading funds are held in and I will try to cover those in this section.

► When you opened your account, it was in your name and your name alone (unless you opened it with a partner), so you own it and have total control over it.

► You are free to withdraw money at any time and this is normally done without expense to yourself. You can top it up whenever you want to add to it.

► When you want to withdraw cash, you will only be able to draw them out if they aren’t still working orders and involved in a trade. The order will have to be closed.

► You can close the account whenever you want, as long as all positions are closed.

► To add and withdraw to it, there will be a specific page dedicated to this on the broker’s website. It is a straightforward transaction, similar to any online banking transaction. All of the instructions are there anyhow to help you out, as well as customer support.

► The forex account manager nor the trader have access to your funds, apart from what you have signed up for.

► The forex managed account team can withdraw the agreed performance fees at the end of the trading period as per the contract when you signed up.

► They have access to your finances solely for the purpose of trading as per the LPOA that you signed previously.

► There are quite a few different trading platforms that different brokers use. Probably the most commonly used is MT4 (MetaTrader 4).

► These are downloaded onto your computer. You will have access to all of the activity that occurs on your account.

► Once finances are credited, then they can start trading for you on your behalf and you will be able to see it in action.

► Also available are all of the reports that you may want to see such as historic trades.

► You will not have access to the platform to place any transactions for yourself.

What is a PAMM Account?

PAMM is short for percentage allocation management module. It is a type of foreign currency exchange trading that utilises pooled monies.

The investor can allocate theirs in the chosen percentage to their preferred trader or money manager. They may manage numerous accounts using pooled cash, along with their own their own capital, with the intention of creating profits.

Clients remain in total control of their own accounts. The team does not have access to them and are unable make withdrawals, apart from the fees.

What is a MAM Account?

MAM is short for multi-account manager. They allows the client to use the percentage allocation method similar to a PAMM account, but it offers superior flexibility to allot the orders and regulate the risk of every sub-account established on the clients risk profiles.

Compound Profit

Albert Einstein was a renowned theoretical physicist, so he obviously knew a bit about mathematics as it was the core of his mathematical models.

He was once reported to have declared that the miracle of compound interest is the “eighth wonder of the world” and most powerful force in the universe. Whether he said it or not, only he knew.

The truth is, compound interest grows exponentially which means that the longer it is maintained, the more interest will accrue.

Compound interest is not only calculated on the principal amount of investment, it is calculated on the principal amount plus any interest from previous periods.

The reason I am telling you this is that the longer you leave your money in your trading account, the greater the yield will be.

Many people use the forex market as a way to top up their salary, as another income stream.

Some clients like to withdraw profits on a regular basis until they recoup their initial deposit. They feel that all returns after that are clear income, which they are.

There is nothing wrong with the above, it’s just that if they were to cease withdrawing funds for a few years, then they could have all of the money they desired.

Anyhow, there are some examples in the “High Returns” section above, detailing how profits can escalate over a year.

Managed Forex Accounts With Good Results

Good results mean different things to different people. At the end of the day, any company that makes you profit is a good result.

There are many not so great companies out there and I cannot stress enough that you need to do your thorough due diligence on them.

Every currency exchange buyer and seller has good and bad periods but you have to remain unemotional about drawdowns, and returns too.

If you have done your homework on the company, then you should understand that these ups and downs are just a natural progression with trading.

If only they could produce gains on every transaction!

A good result to one person might not be so great to another. If your risk profile is not high; if you can’t handle drawdowns well, then a low risk fund with small lots and less profit may be the one for you.

If however you are used to risk and don’t worry as much about large drawdowns, then a higher risk managed FX accounts with larger lots and potentially greater returns, might create a good result for you.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

What is a Managed Discretionary Account?

A managed discretionary account, otherwise known as an MDA, is a financial product or a service, particularly in Australia, where you grant discretion, (the right), to an investment administrator to oversee your investments, maintain, and make decisions about your portfolio on your behalf.

By allowing discretion, as the client, you will always retain complete control and ownership of your portfolio while entrusting the daily decision making about your investments to the discretionary account administrator.

As the client, you will be required to put your signature to a discretionary disclosure, (a limited power of attorney), with the brokerage company as authorisation of your, (the client’s), permission to run your portfolio.

Investing for yourself takes a lot of time and effort, and in a lot of cases, money, to do all of the research, observation and scrutiny, and restoration of the correct balance to your portfolio. Furthermore, the end of year tax reports and returns along with the admin will cost you a lot of additional effort.

The beauty of Australian managed discretionary funds is that they are hands-off. You won’t have to scrutinise your portfolio continually. The administrator will always be searching for the best opportunities, along with reducing the risk by rebalancing your portfolio.

Discretionary accounts have a number of benefits, as listed below.

• Changes in market conditions can happen very quickly and these can be responded to instantly.

• You will have access to the knowledge and skill of professional investment people.

• Strategic and model investment techniques are constantly monitored and actively overseen.

• Maintain control of a flexible investment portfolio that has been designed to fit in with your own personal tolerance to risk, your goals and your preferred asset classes.

• Save on outlay with management expediency.

• Access to an online platform portal from where you have the capability to observe your investment transactions and print out any statements and reports whenever you want.

• No fees for withdrawal and leaving.

• Money saving along with the convenience of the supply of end of the financial year tax reports for your accountant.

MDAs are regulated by the Australian Securities & Investments Commission (ASIC) and the provision of MDA services must meet certain conditions of the Corporations Act 2001, Regulatory Guide 179 and ASIC Class Order CO 04/194. MDAs are run by a Account Operator that must hold an Australian Financial Services License authorising them to provide MDA services. MDA services may operate with an external Account Adviser who generally provides model portfolio solutions.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

Managed Forex Accounts Australia

Below, you can learn more about forex managed accounts in Australia. At Acorn 2 Oak, we aim to assist you in your due diligence by providing bespoke comparison service and comprehensive information.

Are you looking for a managed FX service in Australia that is regulated and is a Corporate Authorised Representative of a body that holds an Australian Financial Services Licence?

DON’T MISS: How to Invest 1 Million Pounds in the UK 2023 – The Best Way?

I will explain more of this later, but why would anyone decide to put money in this alternative investment in the first place?

Well, it is fair to say that currency trading has really taken off in recent years, not only in Australia but around the globe, and many people see it as offering the potential to grab huge profits in a comparatively short period of time.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

On the flip side, there are always risks in any form of financial speculation, but in this instance, one way of cutting down on that risk is to use a service where professional traders trade on your behalf. Reviews of such accounts will demonstrate that they are good from the point of view of effectively managing risk.

In these troubled times, with sources of income dwindling or even drying up entirely, it is only natural that hard-pressed folk look for ways of keeping the money rolling in. FX trading, which is defined as buying and selling different world currencies to exploit fluctuations in their relative values, has certainly increased in popularity of late, and many people have become interested in it as an alternative to buying and selling shares.

However, the problem for currency traders is the same as that facing persons buying and selling stocks and shares, i.e. what goes up must come down at some point. Therefore, riding the FX trading tiger is no easier a proposition than mastering the stock market.

Forex Rise and Fall

As with buying and selling shares and stocks, the currency world has evolved some popular methods to tempt novices to enter the market. Since the average person knows nothing about the currency markets or what makes the dollar rise or fall in value at any particular time, it would seem to be a no brainer that such persons should, without hesitation, sign on the dotted line for a managed FX account.

Now, just what are they, and are they entirely trustworthy? Well, there are two categories of them in Australia. The first type relies on sophisticated computer algorithms to predict how currencies will rise or fall in value going forward.

Of course, no computer system can foresee all global events. Some incidents have impacted the value of the currency market, so this is where a computer system falls down, and an identifiable trend can be reversed in a heartbeat.

The second type of managed FX investment is supervised by a human broker. These brokers use the same computer modelling systems employed in automated FX trading. Still, an additional element of human expertise arguably makes a broker-based system somewhat more flexible than an automated one.

The bottom line with signing up for the currency market game is that there is always a degree of risk involved. You can never eliminate such risk entirely, and imagining you can do so is a fool’s game. Nevertheless, by reading a raft of reviews, you can certainly eliminate the wheat from the chaff and thus keep your risk to a minimum.

At Acorn 2 Oak, you can save countless hours researching as we offer bespoke comparison service and comprehensive information. Read in-depth reviews on wide range forex managed accounts here.

Naturally, it is in anyone’s interest to forget cowboy currency trading outfits and instead narrow down the selection list to the best ones. These are the companies that conduct business professionally and consistently deliver the best returns to their customers.

So, with that in mind, the buying and selling strategies that many managed forex accounts companies in Australia use can generate great returns for investors. In the opening of this article, the company that I was referring to holds millions of dollars/pounds of assets under management (AUM).

This service is responsible for administrating your trading by placing trades and monitoring them for you.

You may have also heard that this type of investment is known as managed discretionary accounts in Australia.

The company should be regulated by the appropriate regulatory body to offer this kind of service to institutional and retail equally. In this case, the Australian Financial Services.

They have several strategies that all have the same objective: to link up people to the prospective profits of the foreign currency marketplace.

Many of the best providers will let you customise the risk by controlling the amount of capital you would like to commit to buying and selling currency. You will be able to choose your drawdown limit, which will stop trading if your account reaches the limit that you have set.

An example of this is :

If you credit your fund with $10,000 and your risk management level is set to 70%, this means that you are willing to risk 30% of your capital, in this case, $3,000.

Losses are inevitable with this type of alternative investment. However, because typically, only a small amount of your cash is committed to each position, it would take a large number of losses in a row for your balance to drop to 70%. Sometimes, the market just doesn’t go the way that you want it to.

Australian providers present an answer for anyone that doesn’t have the disposition to learn all the ins and outs or the required time to buy and sell FX by offering access to a managed service that work toward greater returns.

Deciding on managed forex account is an important decision, and you need to be confident that you have made a suitable choice for yourself. At Acorn 2 Oak, we have tested and proven free service to help you do just this.

UK Managed Forex Accounts

UK forex managed accounts for UK citizens are not only possible but they are plentiful, although not many of them are regulated. We are fortunate over here in the UK because we can open up accounts. Citizens of the US cannot because of the Dodd-Frank Act which stops offshore brokers from accepting US citizens, although some do, somehow.

Most FX management services not only accept UK citizens, in fact, many rely on them. Most other countries, particularly Dubai, United Arab Emirates, invest heavily in them too.

But why would anyone invest their hard earned money in a currency administered account?

• Firstly, a lot of money can be made, and in a short amount of time. Investors are infuriated by most other investments because they yield poor returns. In the United Kingdom, traditional investments such as savings accounts, mutual funds, bonds, annuities etc, yield limited profits but you won’t get rich any time quickly. A managed FX trading fund with a high yield can make you anything from 2% to 20% or more per month with a starting capital of £5,000 typically.

• Secondly, a big reason why these alternative investments are so popular today is that they are run by professionals. The majority of individuals don’t have the time or desire to study and acquire all the essentials and trade with high concentration and care, on a persistent basis. Professional traders do all the hard work so the investor doesn’t have to.

• Thirdly, management of risk is a top priority for fund managers. Accounts should have a drawdown limit which prevents the loss of too much money. Also some will have stops on individual trades. Good traders will have a winning percentage of trades of 70% or more.

• Liquidity is another important deliberation. Money isn’t tied up for any set length of time. Property for example means your capital is tied up in it until you sell it. If you put in a withdrawal request from your fund, in as little as a day, probably two, you can have a little, or all of your funds transferred into your personal bank.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

There are many reasons why investors find these types of investments so appealing. I like the fact that with as little as £5,000 starting capital, it can be turned into almost one million dollars in 6 years. See the spreadsheet below to see what I mean.

In Australia, these products are otherwise known as managed discretionary accounts. They are slightly different in that they generally also include other asset classes and not only foreign currency exchange.

“The wealthiest people of the world are the ones who are willing to, and have taken the most risks. They are prepared to take losses because losses are part of winning. Without taking the risk and being proactive, unless you are lucky, you more than likely won’t achieve your target passive income and live the lifestyle that you have always dreamed of”

Once you decide that you are prepared to invest some money, you will be bewildered by what to do next. Where do you start? It’s difficult because until you go through the process of setting up an account and learning the ropes by actually doing, you will be going in blind and relying on the managed forex companies on what they tell you, but you will probably think to yourself, can you trust them? Is it a scam? I am writing this so that you will have some encouragement and confidence that what you are doing is correct or not.

So you have some funds to invest and are looking for a pro trader to do your trading for you. Which account do you go for? There are hundreds of accounts to choose from. I know that because I am searching all the time to find some to invest in.

Below are some providers that supply UK administered currency funds –

scgforex.com

forexmanagedaccounts-fxmac.com

cityofinvestment.com

forex92.com

priceactionforextrading.co.uk

Check out https://www.forexbrokers.com/guides/united-kingdom-uk for 25 Best UK Forex Brokers for 2020

UK managed forex accounts may differ from managed forex accounts in other countries due to several factors, including:

Regulation: Managed forex accounts in the UK are regulated by the Financial Conduct Authority (FCA), which sets standards and rules for investment firms and ensures that they operate in a transparent and ethical manner. The FCA provides investors with a platform to voice their concerns and resolve any disputes. Other countries may have different regulatory bodies with varying standards and regulations.

Investment strategy: Services in the UK may have different investment strategies than those in other countries. For example, some UK providers may focus on currency pairs that are popular in the UK market, while providers in other countries may focus on different pairs.

Market knowledge: Providers may have a better understanding of the UK forex market than providers in other countries. They may have better access to market data, news, and trends that can inform their investment decisions.

Fees and charges: The fees and charges associated with UK managed forex accounts may differ from those in other countries. The fees may be influenced by the regulatory framework, the level of competition, and the cost of doing business.

Reputation and track record: Managed forex account providers in the UK may have a different reputation and track record than providers in other countries. They may have a more established presence in the UK market and may be more familiar to UK investors.

In summary, UK managed forex accounts may differ from managed forex accounts in other countries due to differences in regulation, investment strategy, market knowledge, fees and charges, and reputation and track record. Investors should do their due diligence when choosing a managed forex account provider and consider these factors when making their decision.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

Frequently Asked Questions

There are many questions that potential investors want to ask before starting a managed forex account. I have listed below the most common questions that are asked. Most of them are generic, which means that they apply to the majority of managed forex companies. There are many more applicable questions that apply to individual companies that I cannot answer here so you will have to check out the FAQ’s on their particular sites.

What Are Performance Fees ?

Performance fees are one way in which managed forex companies make their money. Fees vary with different companies, the majority of them falling somewhere between 25% and 50%.

When Are performance Fees Applied ?

Performance fees will be implemented at the end of every month, as long as there are profits on your account that exceed the high water mark.

What Is A High Water Mark ?

A high water mark is the maximum amount of money created after performance fees are deducted from the account. The high water mark has to be exceeded before any future profits may again be deducted.

For Example – If you opened an account with $10,000 and the performance fees were 25%.

If your profits during the next month were 10%, that would be $1,000 profit for the month.

Deduct performance fees of 25%, which is $250, leaving you $750 net profit for the month.

Your high water mark would be $10,750, which is the original $10,000 plus the net monthly profit of $750.

If you had a loss the next month of $500, no performance fees would be deducted and your new balance would be $10,250.

Only when your account balance surpasses your high water mark of $10,750, will performance fees be deducted and a new high water mark will be created.

What Is A Management Fee ?

A management fee is different to performance fees. Some management fees are a one-time start-up fee that investors have to pay upon opening the account. Some management fees are annual and have to be paid every year.

What Is The Minimum Amount That I Can Invest ?

As a general rule, most companies want a minimum amount of $10,000 to open an account. Some will accept $5,000 and some want much more.

Who Owns The Account ?

The investor owns and controls the account.

Can I Deposit Further Funds Whenever I Want ?

Yes.

How Can I Deposit Funds Into My Account ?

To deposit funds, you will have to go to your brokerage account and follow the instructions.

Can I Withdraw Funds Whenever I Want ?

Yes, as long as all of the trades are closed.

How Can I Withdraw Funds From My Account ?

To withdraw your funds, you will have to download a withdrawal form from the brokerage. You will have specify how and where you want the money sent to, sign the form and return it to the brokers.

Are There Any Fees To Withdraw My Funds ?

No.

Can I Close My Account When I Wish ?

Yes, as long as all of the trades are closed.

Does The Trader Have Access To My Funds ?

No because the funds are in your name at the brokerage. Only you can withdraw, deposit and close the account. The only limited access the trader has to your account is through a LPOA (Limited Power Of Attorney). This enables the trader to trade your account and also allows them to withdraw the agreed performance fee.

What Is Leverage ?

Leverage, (gearing) in the UK, is the degree to which an investor can take advantage of borrowed money. With a small amount of money, an investor can control a lot of money. Leverage varies between brokers from 100:1 even up to 500:1.

For Example – If you opened an account with $10,000 and leverage was 100:1. You have the power to trade $1,000,000 of currency. You only have to put down 1% of the total transaction amount.

You can make a huge amount of money with leverage, BUT, you can lose all your money in no time at all.

What Is LPOA (Limited Power Of Attorney) ?

LPOA or (Limited Power Of Attorney), is a form that the investor signs that permits the trader to perform certain account actions, such as to trade the funds for the investor and take out performance fees. They cannot withdraw other money or carry out any other primary functions.

Is The Limited Power Of Attorney Permanent ?

No, the Limited Power Of Attorney is not permanent. You can rescind it at any time.

Can I See My Account In Action ?

Yes, you will receive a link from your forex account manager to download the trading platform onto your computer. Most brokerages use the MT4 (MetaTrader 4) platform. You will receive your log in details so that you can see your account history, download account history and see current trades in operation.

Will I Need To Sit In Front Of My Computer All Day ?

No, all the work is carried out by the management team.

When Will I Start To Make Money ?

As soon as you have opened up an account and your deposited funds have cleared, then the traders can start trading.

Do My Funds Compound Automatically ?

Yes, your profits will be added to your account balance and be used in any future trades.

Can I Place My Own Trades In My Managed Account ?

No, only the trader can trade your account by virtue of the LPOA or (Limited Power Of Attorney) that you have given them.

Do I Have To Open Up An Account With A Broker ?

Yes. In order for the account manager to make trades on your behalf, you will have to open up a brokerage account.

Great content on managed Forex accounts!

Thank you, Martin!