Welcome to my forex managed accounts reviews site. If you want to find out more about FX administered funds in general, you can check out – Discover Forex Managed Accounts – The Only Guide You Need.

I wanted to do a review site because nobody else was really doing it. I have invested in several but none have really set the world alight. Some have been awful, to say the least.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements

You can read more about them on this site on various pages.

It’s very difficult to make a list of providers because they come and go very quickly. There are not many that stand the test of time. That’s why a minimum of a 2 year independent audit is recommended.

Forex managed accounts come and go. There are a few reasons why some are better than others. Maybe they generate great returns, maybe they are regulated or maybe they have been reliable for a long time.

Every once in a while, one or two companies really stand out from the rest. At the current time, there is one company, or two, whichever way you want to look at it. That is because they have one branch regulated in the UK under FCA regulations, and one branch in Australia, under ASIC regulations.

The reason this company stands outs from the crowd is for all the reasons mentioned above. It has a third party 3 year independently audited account performance report. I have never seen this before. 2 years is the most I have ever seen prior to this.

Secondly, as I said previously, they are regulated in two countries. I know in Australia there are quite a few regulated accounts but in the UK, you will struggle to find any, apart from this company.

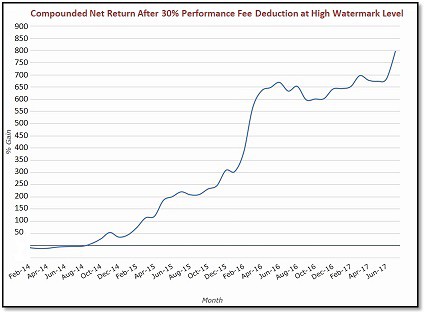

Thirdly, and definitely not lastly, over the last 3 years, they have made their clients over 800% profit, and this is after the performance fee is deducted.

I am sure these factors will make you sit up and take notice. If they have, you can find out more about them on this site. For the UK regulated company, click here.

FX administered companies that we have reviewed on this site –

- Hartswell Captal

- Equitimax

- Wealthified

- Solidary Markets FX

- Thefxhelpers

- Vista FX

- JAD Capital

- Synergy FX Funds

- Think Huge Investments

- Yadix FX

- Forex Hub

- Diamond FX

- Drashta Capital

- FX Perpetual

- Exential Group

- FXMA

- Forexsson

- Jackson Capital

New UK FCA Regulated Account

You may want to check out this account that has only just opened up in the UK. The great thing about this account is that it is fully FCA compliant in the UK.

The other unique factor that you may carefully consider is that YOU can set the amount, up to 80%, that you want to risk. So, if you only are prepared to lose 20% of your capital, then you can do so.

If you want to compare performance results and fees of managed forex accounts providers, follow the link below and fill out the form on the next page. You will receive up to 4 bespoke FREE quotes from top-ranking fund managers that best matches your requirements