WHAT IS FOREX TRADING?

Foreign Exchange is more commonly known as Forex or FX. The simplest form of currency exchange is familiar to us when we go on holiday. We take our pounds to the bank and exchange them for the currency of the country we are visiting at the rate set by the banks that day.

Of course this is a simple currency exchange not trading. Forex trading occurs on the foreign exchange markets where traders can buy and sell currencies along with banks, commercial companies, investment management companies, hedge funds, retail foreign exchange brokers and individual investors.

DON’T MISS: Compare Top FX Brokers and get up to 4 free, no-obligation quotes

Years ago, foreign exchange trading was only available to the big banks and institutions. Still, thanks to greater and greater technological advances and internet access over the past 15 or so years, individual traders can now easily access these foreign currency trading markets from their pc in the comfort of their own homes.

If you don’t have the time or the inclination to learn forex trading for yourself, why don’t you look at a forex managed account. Professional traders will do all of the work for you. Alternatively, check out copy trading where you automatically copy the trades of the top traders.

Let Acorn 2 Oak connect you to the very best Forex Course providers currently available. Get up to 4 FREE quotes from high-quality Forex Course providers in just a few clicks

HOW DOES FOREX TRADING WORK?

Forex is the most traded market globally, turning over more than 5.3 trillion US dollars per day. The New Zealand market is the first to open, followed by Australia, the Asian markets, the Middle East, Europe and the UK and then the USA, trading 24 hours a day worldwide for five and a half days.

Currencies are bought and sold on the foreign exchange markets according to technical and fundamental analysis, buying and selling with the aim to make a profit as currencies rise and fall.

We need education and foreign exchange courses to safeguard ourselves from entering into currency trading recklessly, without even knowing the simplest rules. It is vital to learn about trading and the basics of foreign exchange through an online forex trading training course, such as enrolling on a class.

From understanding the NFP report (non-farm payroll) and known events like the vote for Brexit and what Boris Johnson does next to natural disasters and unexpected occurrences like a terrorist attack, currencies can quickly swing from one direction to another. Being taught how to stay out of a trade can be as important as knowing how to learn to trade, i.e. placing a trade, from a purely technical aspect.

FOREX EDUCATION AND THE MT4 TRADING PLATFORM

An education in forex is an absolute must for anyone considering investing their hard-earned cash into the foreign exchange markets.

To become skilled at trading the market with an education course, consider a free trading course as the first foray into acquiring trading terminology and the basic introduction to how to trade.

Look for a free introductory course online with forex trading classes for beginners. You will discover from step one and get a base knowledge about currency trading before paying for currency trading training.

READ ALSO: Compare Forex Lessons Providers 2022

The MT4 (Meta Trader 4) trading platform is the most widely used and trusted automated electronic trading platform. Any course, whether it is an online version or a trading institute, should teach the functionality of the MT4 trading platform as an absolute necessity.

FOREX TRADING COURSES

There are various ways to learn to trade that answer different peoples learning capacities. The best course that will enable a person to become skilled at being a trader uses the methods and format that suits a person’s preferred style of learning. Some people enjoy an auditory course, some prefer a visual method, some prefer seminar/classroom style, and others prefer to access PDF’s.

Not everyone is comfortable with an online forex trading training curriculum and would prefer a seminar or classroom environment and the hubbub of other people to bounce ideas off and have an open discussion.

Some people still love paper and will learn trading more easily by seeing content written clearly before them step by step.

Most of us have attended a seminar and sat classroom style or theatre style listening to the speaker, whether it was a work commitment, stock market courses, currency exchange courses or any other courses. Some of us are familiar and comfortable in this setting.

Others prefer the convenience of the same format but would prefer to learn to be a trader from the comfort of their own home by attending an online webinar. Not all online courses offer webinars, though.

Let Acorn 2 Oak connect you to the very best Forex Course providers currently available. Get up to 4 FREE quotes from high-quality Forex Course providers in just a few clicks

Check that the online course offers lessons with a one-on-one teacher or trainer and the opportunity to attend online webinars later on after gaining more knowledge. A webinar is an excellent training tool provided the student is advanced enough to understand what is being taught.

The trick to becoming a successful trader is finding the best course to suit the preferred style of education and understanding the functionality and the trading psychology. When it comes down to the simplest rules to learn a trade, it is imperative to accept the losing trades along with the winners.

Any forex training course or currency courses with any merit should be teaching the art of having more profitable than losing trades and ideally making those profitable ones larger than the losing ones.

THE INDUSTRY OF FOREX TRADING COURSES

The industry of forex educational products and specifically the internet phenomenon has come about with the advent of the advances in technology and the fact that the average individual can now place trades directly into the foreign exchange markets themselves by way of a trading platform.

Of course, the best training will be linked to the most reputable brokerage house. In some countries, the course itself must also be licensed. For example, in Australia, ASIC regulates any trading company, whether it is an online course or teacher/student course.

The best teachers will train a certain component of the online forex course one on one, periodically do review sessions with the students and lead the more advanced webinars.

As previously mentioned, there is a certain amount of knowledge to be obtained from free courses online but not necessarily enough to move forward to real-time trading.

THE INDUSTRY OF TRADING CURRENCIES

Indeed research the crash of 1929 and other market crashes like 1998 and 2008 to see the fundamentals at work and what happens to the world stock markets and foreign exchange markets.

Currencies fluctuate all the time and revolve around news from other markets too, like the price of gold, the price of oil, Wall Street and what the stock exchange is doing; The FTSE (UK), S&P (USA) and ASX (Australia) for example. Look at the currencies of Greece, Iceland, Spain and Italy and the bank bailouts. Be aware of such things as the likelihood of a Flash Crash, for instance, after the UK voted for Brexit. Take a look at the effects of such unexpected tragedies like 9/11 and 7/7.

We know that most major stock exchanges have the big bull outside, the bull symbolising a rising market and the bear symbolising a falling market. Well, the experienced stock market trader can, of course, trade-in options and make money on a falling stock market. Still, when learning to trade forex, the same knowledge enables a currency trader to trade each side of the currency.

Apart from trading terminology and technology, another area to become familiar with using a free forex training course is the currency pairs. Forex traders aim to take profits based on the fluctuations of the currency prices. Some traders have no interest in the fundamentals. Some simply watch the technical movements on the charts.

Let Acorn 2 Oak connect you to the very best Forex Course providers currently available. Get up to 4 FREE quotes from high-quality Forex Course providers in just a few clicks

CURRENCY ABBREVIATIONS

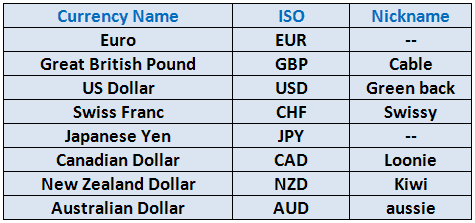

Where to learn to trade? One of the first components to take advantage of free forex courses online is learning the terminology for the currencies themselves. Mainly, if a country’s money is the dollar, two letters associated with the country will be used, followed by ‘D’ for the dollar.

For example, USD, the US dollar, CAD is the Canadian Dollar, AUD, the Australian dollar and NZD, the New Zealand dollar. In Japan, they use the Yen hence JPY, and in the United Kingdom, of course, we use the pound, GBP, Great British Pound. Switzerland is CHF, and Europe has the Euro, EUR. Southern Ireland, of course, uses the EUR, and Northern Ireland being a part of the UK, uses the GBP.

Some of the currency pairs have nicknames for simplification. For example, when the Swiss currency CHF is paired with the USD, it is called the Swissy. South Africa has the rand, and their three-letter code or international currency code is ZAR.

DON’T MISS: Can I Hire Someone to Trade Forex for Me, On My Behalf?

CURRENCY PAIRS

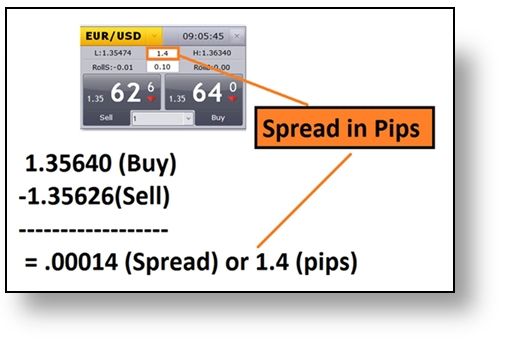

The most frequently traded currencies are the majors. They are all crossed with the USD and offer lower rates between buying and selling prices. This gap or difference is the spread. This is how most brokers exact a cost for the transaction and the service. Rather than pay a fixed fee, often the difference is paid between the two prices, or a small fee and the difference between the two prices. In the same way, the currency exchange booth takes a piece on either side of the exchange rate as a commission when selling and buying back holiday money.

Having said this, generally, the difference between the buy and sell price, or the spread, on a trading platform is far lower than the difference when changing currency for a holiday. If a currency is not crossed with the USD, the majors, the other main currencies traded are crossed currencies.

These are called cross rates. These exchange currencies like GBP EUR JPY AUD crossed also offer low spread rates between the buy and sell price. The more exotic and less traded currencies like the Mexican peso, the Norwegian kroner, and Thai baht will often have much larger spreads and therefore are more expensive to trade because of the transaction cost. For example, GBP/AUD or EUR/GBP is not considered majors because they do not include the USD.

Let Acorn 2 Oak connect you to the very best Forex Course providers currently available. Get up to 4 FREE quotes from high-quality Forex Course providers in just a few clicks

Many brokerage firms have an international presence and will offer the same digital content for forex courses free to their customers showing perhaps what trade to learn first or the easiest trade to learn. This will have far less interaction than, let’s say, a course offering one-on-one mentoring or an fx class or workshop.

FOREX TRADING COURSES IN DIFFERENT COUNTRIES

When looking at courses in different countries, there are slightly different governing rules for instance as mentioned earlier Australia’s governing body is ASIC (Australian Securities and Investments Commission. New Zealand FSP is the government body overseeing financial services companies, the New Zealand Financial Service Providers.

Not all foreign exchange training and foreign exchange courses need a license, but all brokerage houses do. Some brokerage firms offer a free online course to learn how to trade the market as part of the enticement to use their brokerage for placing trades. They may offer a seminar as an introduction to their brokerage.

In the UK, the trading forex course itself does not need to be licensed, but to place trades, the customer generally uses the brokerage they are affiliated with and that brokerage will be licensed. The most important thing to look out for when selecting a forex broker is the broker’s regulatory status and which regulatory authority they are approved by. Ideally, there will also be access to an online course free when trading with that brokerage.

As mentioned, the bigger forex brokerage firms offer a course as part of the package when trading with them. This may be an international brokerage offering the same course online whether the new customer is a beginner, intermediate or advanced with vast experience in trading forex markets. Ideally, there will be a helpline or email support option. However, there may be little or no interaction with an experienced teacher.

A person who wants to learn for free may not realise the intricacies of trading the foreign currency markets and the dire effects of diving straight into the live markets. The inexperienced trader needs to learn the trade or trading with an education package provided in the country of domicile. This course should have all mediums of education available and one to one lessons with the teacher provided with the training course.

Let Acorn 2 Oak connect you to the very best Forex Course providers currently available. Get up to 4 FREE quotes from high-quality Forex Course providers in just a few clicks